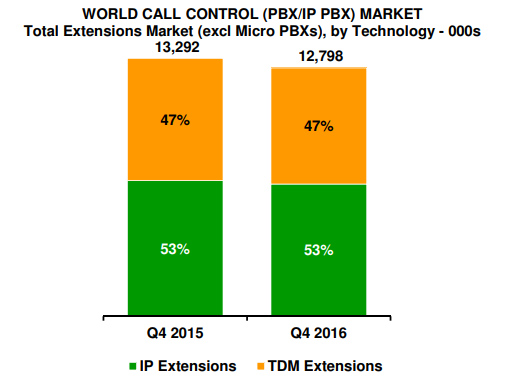

According to the latest market research published by MZA Telecoms and IT analysts, the figures released in the fourth quarter of 2016 show a significant drop in the global call control licenses and extensions market. In fact, throughout the world, the market saw a volume drop of around 4%, although some regions were more affected than others.

The drop was more apparent in the SME market, for people seeking solutions for less than 100 licenses or extensions, with a drop of 5%, compared to only a 3% decline in the enterprise market. You can download the full report here, for a closer insight into the statistics.

Assessing the Changes in the Call Control Market

The call control market, which includes IP PBX, and PBX extensions within all shapes and sizes of business around the world, has seen some significant changes in recent years. In part, this could be attributed to the new emergence of technology and communication strategies. On the other hand, it may be that changing business strategies and rising competitors in the space have left the marketplace in a state of uncertainty.

In EMEA, the performance of the call control market remained relatively flat, thanks in some part to the revival of Unify, and the growth of Mitel. While Western Europe saw a drop of around 1%, the Middle East, and Africa experienced volume reductions of 4%, despite the fact that growth from Ericsson LG, Huawei, and Karel were driving the market forward. Interestingly, Eastern Europe saw positive results in comparison to recent quarters, potentially due to the growth of Unify OpenScape and Huawei eSpace.

North America had a big part to play in the marketplace over the last year, with call control volumes dropping by 9% year-on-year. Some analysts suggest that this change might be attributed to the uncertainty surrounding Avaya and the chapter 11 journey, although it’s hard to know for sure what the real cause might be. Asia Pacific saw a drop of 4% year-on-year, driven by a 20% drop in volumes throughout Japan.

Finally, Latin America saw a moderate decline in their call control volumes compared to previous quarters, with a drop of around 5%. While some significant projects throughout the region have begun to steer the major markets of Latin America into growth, there’s still a relatively complex business environment to consider in Brazil, thanks to ongoing economic turmoil.

Finally, Latin America saw a moderate decline in their call control volumes compared to previous quarters, with a drop of around 5%. While some significant projects throughout the region have begun to steer the major markets of Latin America into growth, there’s still a relatively complex business environment to consider in Brazil, thanks to ongoing economic turmoil.

Understanding the Marketplace

As the MZA assessment shows, despite the drop in call control market solution volumes, it’s worth noting that several big-name UC brands have seen significant growth in the last year, including Cisco, Huawei, Mitel, Panasonic, Microsoft, Unify, and more. With the launch of new platforms and services from countless providers, we’re beginning to see some significant changes in the communications competitive landscape.

The report also suggests that IP licenses and extensions on a global basis saw a drop of around 3% year-on-year too. The analysts responsible for the report indicate that market declines in the IP-focused market of North America might be the cause for this reduction. Ultimately, Cisco continues to lead the market share for IP licenses with 19% share, while Avaya has earned second place with a reach of 12%.