Things don’t look great for the call control licenses market, according to the latest reports released by MZA Telecoms and IT analysts. Following up from the figures released surrounding the Q4 results for 2016, which indicated a year-on-year drop of about 4% globally, the group released additional findings at the end of September, showing that the decline has continued at an even faster rate.

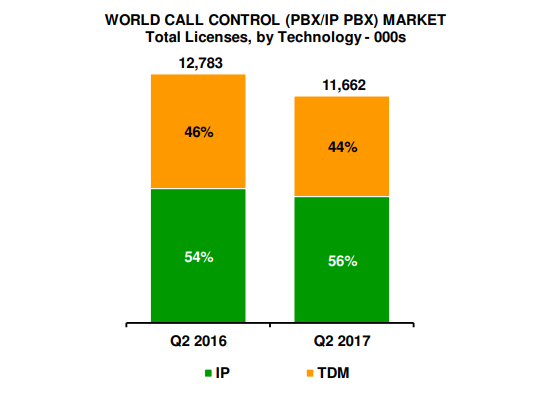

In the second quarter of 2017, the market fell to approximately 11.7 million licenses, demonstrating a second quarterly decline of 9% year-on-year. This continues from a 7% drop during the first quarter of the year, although global sales had grown by around 8% sequentially for call control license sales, thanks to seasonality.

You can see the full report here.

Rapid Decreases in Call Control Licenses

According to MZA, declines were apparent in both the SME segments, for solutions with less than 100 licenses, and the enterprise segments, for solutions with more than 100 licenses at the same rate of 9%. Apparently, most of the decline was driven by a rapid loss in North America, which saw several issues following the disruptive behaviour by many vendors, including Avaya, Mitel, and Toshiba.

2017 has delivered countless changes to the Call Control market for America. Not only did Avaya file for chapter 11 in January, but Mitel created a merger agreement with ShoreTel, and purchased Toshiba in 2017. Altogether, these changes have created a significant amount of uncertainty in the marketplace which steered North America into decline faster than ever.

2017 has delivered countless changes to the Call Control market for America. Not only did Avaya file for chapter 11 in January, but Mitel created a merger agreement with ShoreTel, and purchased Toshiba in 2017. Altogether, these changes have created a significant amount of uncertainty in the marketplace which steered North America into decline faster than ever.

At the same time, regional declines became more apparent in Asia Pacific when the Japanese market saw a double-digit drop, though India, China, and Australia remained relatively stable. In Western Europe and Northern America, enterprise solutions experienced greater declines than SME strategies.

Ultimately, only Eastern Europe and Latin America saw growth in the second quarter compared to previous 2016 Q2 sales volumes. Eastern Europe experienced the best results, with Ukraine, Hungary, Poland, and Russia rates remaining relatively stable. Throughout Latin America, MZA suggests that the market was held aloft by the positive performance of Cisco and Huawei.

The Changing Competitive Landscape for 2017

Though much of the telecommunications market has changed in 2017, it’s worth noting that Cisco continues to hold the top spot when it comes to call control licence sales. Despite a record-breaking decrease in market share of 12%, Cisco has managed to hold onto many of their customers, though companies like Huawei are quickly becoming more competitive thanks to their significant growth in EMEA and Latin America.

Today, Huawei has earned the “second place” spot for market share in the call control licenses market, with a 10% share, followed by Avaya and NEC who recorded shares of 10%, and 9%. Mitel held its position in fifth, with an 8% share of the market in the second quarter of 2017, despite the fact that the company gained better presence within the global market for SMEs.

Panasonic also stayed steady within sixth position, followed by varied competitors, including Alcatel-Lucent Enterprise, Microsoft, Unify, and Ericsson-LG.