Compliant communication used to be easy.

Lawyers, bankers, and financial services experts would fax each other, or perhaps record their conversations and have them transcribed, printed, and filed with all the other reams of vital documentation that may or may not be required again at some unknown date in the future.

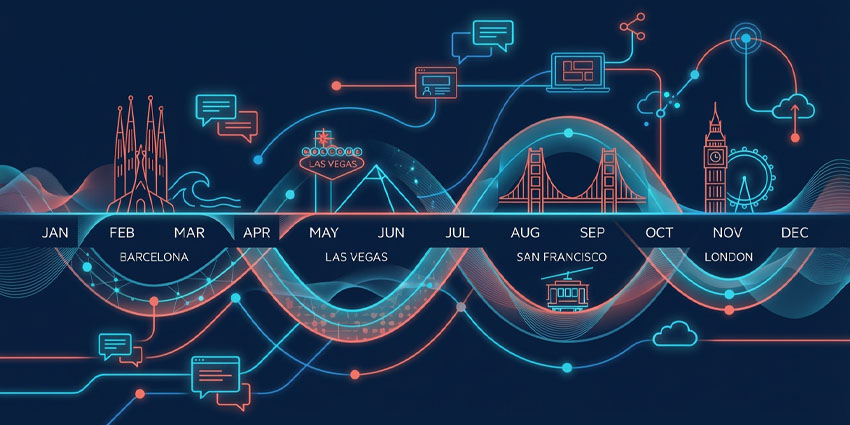

Of course, that’s all changed for the better now. The digital, omnichannel, always-on environment in which those same practitioners operate today enables them to communicate at lightning speed via a myriad of unified channels.

Voice, email, video, SMS, chat, and whiteboards – the conversations can occur however and whenever is most appropriate. It all makes for a more efficient, more productive process that delivers a slicker, more satisfying customer experience.

However, there is a tricky dichotomy at play. As the communicative convenience has increased, so has the number of rules and regulations with which financial services organisations must comply. Data storage, privacy, fraud, money laundering, due diligence, market abuse – different regulators in different countries with different rules have jurisdiction over it all, and the penalties for non-compliance can be catastrophic.

For those organisations (and their technology partners), deploying smart and powerful data capture, storage, and retrieval solutions is business-critical. All they must do is pick a provider which not only understands the issues at hand, but also has the product set and expertise to make it happen.

“It’s no surprise that financial services organisations have adopted the unified communication applications and platforms out there that drive efficiency and deliver enhanced customer service – but with all of that new capability comes greater governance challenges,” says Garth Landers, Director of Global Product Marketing at leading security solution vendor Theta Lake which has recently published its fifth annual survey of 600 compliance professionals, 74% of which say they face significant struggles searching for and retrieving modern communications.

“Their users are engaged, and the velocity and volume of content is exponential. That means those tasked with conducting and responding to compliance enquiries or governance events such as audits, investigations, or litigation must find and retrieve communication information from multiple platforms that in some cases are accessed by dozens, hundreds or even thousands of users.

They also have to do all of that in a timely manner and be 100% accurate. Having the right tools can make all the difference.”

Theta Lake – with which many of the world’s major unified communication and collaboration platforms are strategic partners and investors – offers API and Machine Learning-powered solutions to regulated industries like financial services which automatically capture, store and secure relevant governance-related communications in a globally-compliant manner.

Their Unified Capture and Search products provide users with a ‘big picture’ view of compliance-specific omnichannel communications as well as the ability to drill into the detail of specific interactions and create a case.

“Over the last two years, we have seen a tremendous number of fines and penalties handed out by financial services regulators for unauthorised communications and breaches of record-keeping regulations,” says Landers.

“Organisations want to be as productive as possible, and they want their customers to be as engaged as possible. However, no-one wants to be on the front page of the Financial Times or The Wall Street Journal and suffer reputational damage.”

As well as its modular product offerings, Theta Lake also supports both its customers with expert counselling, advice and guidance. Its highly-skilled Regulatory Intelligence team is in constant contact with regulators across the globe and shares emerging themes and issues via regular, informative, peer-to-peer webinars.

“Having that close, expert support can be a real differentiator for end user financial services organisations looking to understand how technology and governance intersect,” says Landers.

“It enables all parties to demonstrate high levels of knowledge and competence. Customers of financial services providers in particular can feel confident that they are partnered with institutions that are fully-compliant and approach the issue of governance in a highly-responsible way.”

That sounds like it’s an investment that is highly-likely to pay off…

To learn more about how Theta Lake can help your and your customers’ businesses respond to the challenges of communication regulation, click here.