Over recent years, the pandemic has transformed the way businesses communicate both internally and externally, with remote work putting Unified Communication and Collaboration (UC&C) front and center. The use of platforms like Teams, Zoom, and Webex became second nature; and the quick deployment of these solutions gave rise to new privacy and security concerns.

While it’s been over four years, we can still see the consequences of this rushed process, some of which have been significant for financial institutions. From evolving regulations to productivity concerns—which have been the number one driver of software purchases in banks over the past 12 months—challenges continue to pile up.

What are the main hurdles that financial services face, and how can Performance Management solutions help?

UC&C Management: Challenges for Financial Organizations

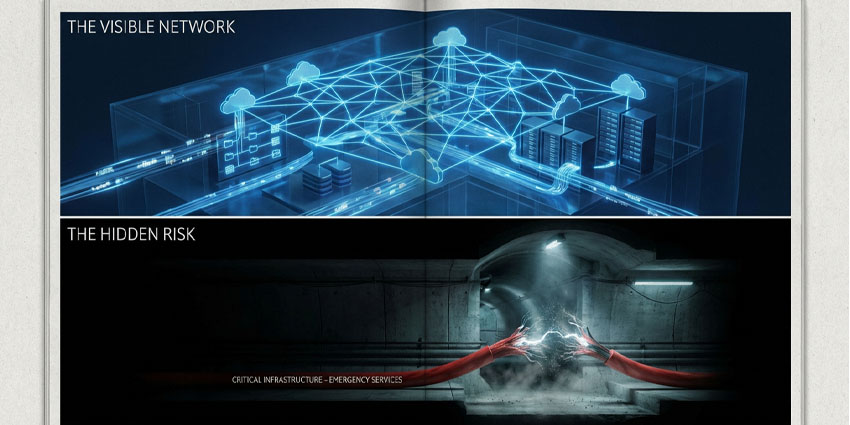

Financial firms are now required to manage and monitor complex, digitally transformed communication environments, with three key areas where they encounter difficulties.

Complexity Magnified: Technical glitches can result in operational inefficiencies, which in turn damage customer experiences and can potentially lead to churn. In finance, detecting these is a unique challenge:

“From 2001 to 2020, mergers outnumbered new financial institutions 5 to 1, leading to widespread technology and network integrations,” explains Gary Paxton, Account Executive at IR.

This results in particularly complex scenarios where a call that originates in one system ends up on an entirely different system, with limited ability to trace it and detect problems.

“When an issue occurs, there can be numerous potential sources (internal or external), and it can be extremely tricky to locate the root cause.”

Inefficient Communication: When agents work remotely, how can banks ensure they’re ready to take calls from customers?

“This has become a significant challenge for banks since the pandemic,” Paxton notes.

“Beyond the multitude of platforms, they now need to be able to monitor agents’ laptops, home Wi-Fi, and headsets.”

Siloed Data: While banks hold an incredible amount of customer data, siloed systems make it hard to leverage this data for reporting and generating insights to improve customer experience (CX).

“When they choose to roll out a new service or division, it’s common for financial firms to build entirely new teams,” Paxton says.

“They purchase new buildings, technology, platforms, and tools—creating a situation where services are dispersed, with different tools monitor each,” Paxton says.

When data comes from various systems and platforms—some in house, some in the cloud—it’s difficult to maximize its potential.

UC&C Performance Management: How Can IR Help?

Considering these newly added complexities, financial services can benefit greatly from investing in UC&C Performance Management solutions such as IR Collaborate.

“UC&C is crucial for financial services as it serves as their public persona, impacting how customers perceive their professionalism and trustworthiness,” Paxton explains.

“Clients today expect seamless communication across all channels, and when it’s poor, they may question the firm’s reliability and competence.”

Collborate helps streamline interactions to build customer confidence and strengthen loyalty. By unifying all platforms and systems into a single pane of glass, it allows financial firms to view and analyze their data in one place. With end-to-end visibility into conversations, Collaborate helps locate the source of issues, significantly reducing mean time to repair. The remote agent testing tool also enables firms to track remote network environment and equipment.

“At the end of the day, inefficient communication costs money and time,” Paxton concludes.

“By being able to quickly identify there’s a problem and where it’s coming from, companies can avoid downtime and be confident they’re providing great customer experiences.”

Visit the IR website to find out more about how they can help financial organizations overcome performance management challenges and simplify UC&C complexity.