ServiceNow has completed its acquisition of Moveworks for an undisclosed amount, combining its workflow automation platform with Moveworks’ conversational AI assistant to strengthen its position in the fragmented employee service automation market.

The deal arrives as enterprises struggle to move AI pilots into production, with the newly combined company citing deployment across 5.5 million employees and 250 shared customers as evidence of proven scalability.

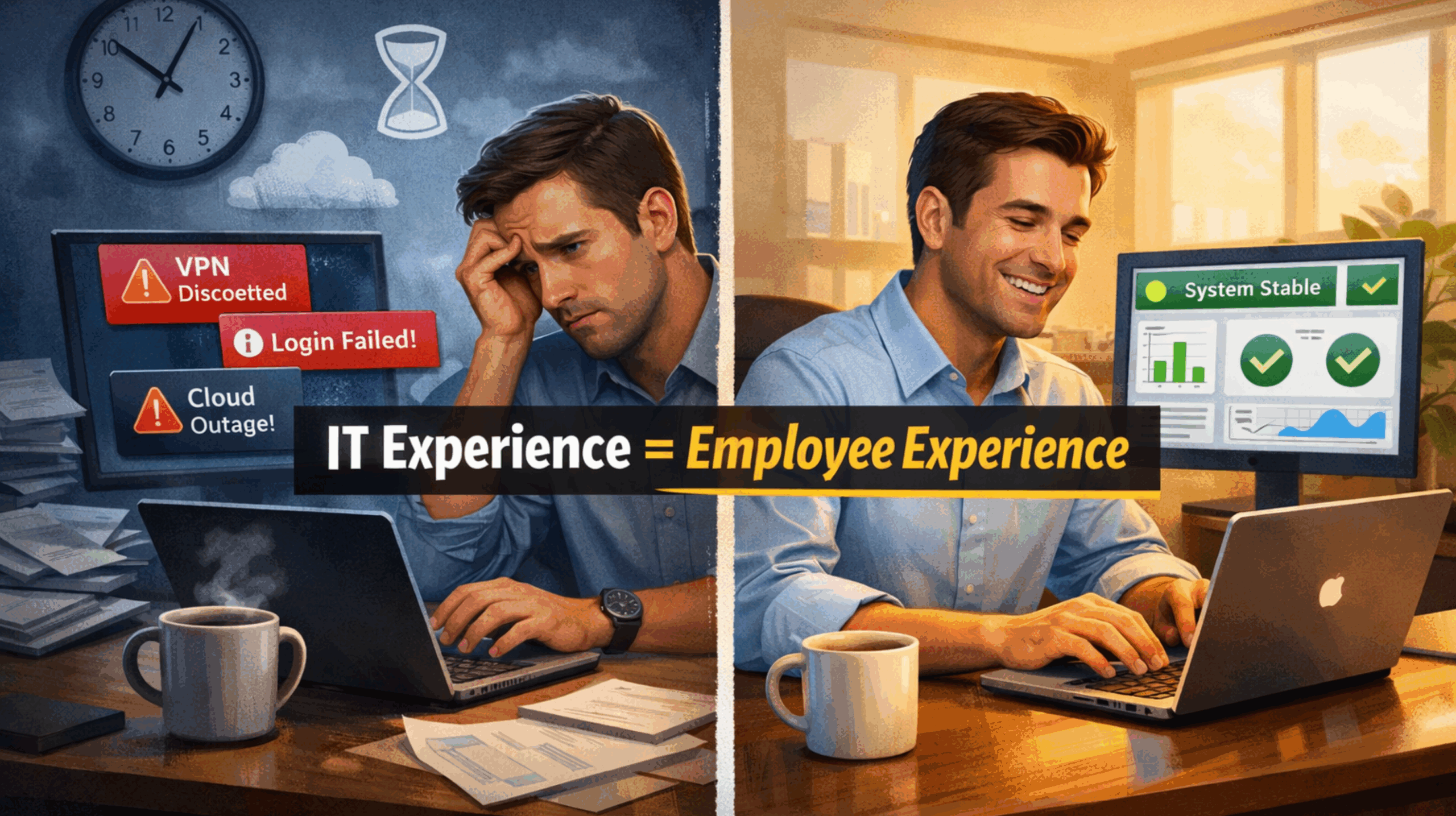

The strategic rationale addresses a persistent challenge in enterprise AI: powerful automation capabilities often go unused because employees find them difficult to access. ServiceNow brings two decades of workflow intelligence across IT service management, HR operations, and enterprise processes. Moveworks contributes its natural language interface, enterprise search capabilities, and what it terms an ‘agentic Reasoning Engine’ designed to make those workflows accessible through simple conversational requests.

Amit Zavery, ServiceNow’s President and Chief Product Officer, commented:

“With two decades of workflow intelligence built into a single architecture, we’re powering the agentic AI operating system for the enterprise.”

The company claims that its AI agents now resolve 90 percent of internal IT requests and 89 percent of customer support inquiries autonomously, cutting resolution times nearly sevenfold; however, it hasn’t disclosed baseline metrics for comparison.

The Adoption Question

The business tech landscape remains littered with AI initiatives that stall at the pilot stage. Moveworks’ deployment statistics offer an intriguing counternarrative: nearly 90 percent of its customers have rolled out the technology to their entire workforce, not just test groups. Users include Siemens, Toyota, and Unilever, suggesting the platform has cleared the adoption hurdles that plague many enterprise AI tools.

The use case is straightforward. Hypothetically, an employee types “I can’t access the customer database” into their collaboration tool. Rather than creating a ticket and waiting hours for an IT response, the AI assistant identifies the issue, verifies permissions, triggers the workflow, and restores access within minutes. Similar patterns apply to HR policy questions, cross-departmental requests, and routine service inquiries.

For organizations calculating their return on investment, the value proposition hinges on three key factors: reductions in service desk staffing costs, productivity gains from faster issue resolution, and improved employee satisfaction scores. ServiceNow hasn’t published detailed ROI data, but the sevenfold improvement in resolution times suggests substantial efficiency gains, assuming a successful implementation.

Integration and Governance Reality After the ServiceNow Moveworks Acquisition

The 250 mutual customers provide a natural testing ground for integration, though questions remain about migration paths for standalone Moveworks clients and pricing structures post-acquisition. ServiceNow is already ranked among Moveworks’ 100-plus technology integrations, which should ease technical consolidation.

However, enterprises considering the combined platform face familiar integration challenges: data quality requirements, system connectivity prerequisites, and change management across potentially thousands of employees.

The security and governance dimensions become particularly acute when AI agents gain autonomy to access sensitive systems and trigger workflows without human oversight. Bhavin Shah, Moveworks’ CEO, emphasized “trusted workflow automation and AI governance” in announcing the deal.

The addition of hundreds of Moveworks AI specialists to ServiceNow’s engineering organization accelerates product development at a moment when AI capabilities are evolving rapidly. For enterprises evaluating long-term platform partners, the depth of talent matters as much as current feature sets.

The Competitive Landscape

The acquisition strengthens ServiceNow’s position against competitors in IT service management and employee experience platforms, including Workday, BMC Helix, Salesforce Service Cloud, and Freshworks. The move toward platform consolidation reflects broader market dynamics as enterprises seek to simplify the management of multiple point solutions.

While ServiceNow’s offering serves different primary functions than productivity-focused AI tools like Microsoft Copilot, both compete for finite enterprise AI budgets. The strategic question for many organizations is whether to invest in integrated service automation platforms or assemble capabilities through combinations of existing tools, such as Microsoft Power Platform, Dynamics 365, and various best-of-breed solutions.

The platform consolidation approach offers potential advantages in unified governance, simplified vendor management, and seamless data flow across workflows. The trade-offs include higher costs, potential vendor lock-in, and reduced flexibility to adopt emerging specialized solutions.

The Implementation Calculus with ServiceNow and Moveworks After Acquisition

The central challenge for tech buyers isn’t whether autonomous AI service automation works in principle; ServiceNow’s internal metrics suggest it does. Instead, the issue is whether it will work effectively in their specific environment, taking into account their legacy systems, data quality realities, and organizational culture.

Companies that are already seeing sevenfold improvements in resolution times have answered that question affirmatively. For others, the decision hinges on implementation complexity, total cost of ownership over three to five years, and strategic alternatives, including best-of-breed approaches or building capabilities using existing enterprise platforms.

The acquisition provides a blueprint for platform consolidation in enterprise AI service automation. Whether that blueprint fits your organization’s architecture, budget constraints, and strategic priorities requires careful analysis beyond vendor performance claims. The proof will emerge not in acquisition announcements, but in production deployments across diverse enterprise environments over the coming year.