Fraudscape is the only publication available within the UK today that provides a full and in-depth analysis of the country’s external and internal fraud trends. According to the latest news revealed by Fraudscape, the risk of fraud is on the rise, with Cifas membership organisations reporting a record 305,564 instances of fraudulent conduct in 2017. This is the highest number of identity fraud issues every recorded by Cifas respondents.

The Fraudscape report provides financial crime professionals, law enforcement organisations, journalists, and more with an accurate insight into the risk of fraud in the world today, and the attempts made to steal caller information in the UK. Some of the key findings offered by the report this year include the fact that young people are the most likely to act as “money mules” with a 27% increase in 14 to 24-year-olds carrying out this fraud. Additionally, over a third of bank account takeover victims were found to be over the age of 60.

Fighting Fraud: Pindrop’s Response to Fraudscape 2018

To create the report, the Insight team behind Fraudscape record huge amounts of data delivered by Cifas membership organisations within the National and International Fraud databases. This information allows Insight to identify some of the key changes and trends in fraud behaviours.

To create the report, the Insight team behind Fraudscape record huge amounts of data delivered by Cifas membership organisations within the National and International Fraud databases. This information allows Insight to identify some of the key changes and trends in fraud behaviours.

This year, it’s clear to see that the landscape is growing increasingly complex and dangerous. In response to the latest research from Fraudscape, the research director for security company, Pindrop, Nick Gaubitch, noted that the highlights were “worrying”. Around 4 in 5 victims said that fraud compromised their genuine addresses – and according to Pindrop, this result is less surprising than you might think.

As experts in the world of call centre security and management, Pindrop is at the forefront of research into the relationships between customers and their contact centres. In 2017, Pindrop found that 61% of their customers naturally provide the answers to their security questions on their social media profiles, showing off information like their personal address and date of birth.

Social Media Could be the Gateway to Fraud

The results of both the Fraudscape and Pindrop studies suggest that social media could be responsible for the rise in fraud issues. At least, the dangerous use of social media is not making the issue any better. For many organisations, information like birth-dates and addresses are used to form authentication questions that allow people to access their personal accounts. If this information is public knowledge, then security begins to crumble.

In a space where fraudsters are becoming increasingly sophisticated, it’s up to the modern business to ensure that all their channels of communication are fully defended. Now that contact centre fraud attacks have increased at a rate of 113%, the phone channel is a highly vulnerable area of the business, and online security is maturing exponentially as a result. Though online security is growing, phone security appears to be one of the weakest lines of defence for any organisation. The question is, what should the call centre be doing about these fraud threats?

The first step is making sure that customer data is truly secure in the contact centre. One report from Symantec found that businesses may not always recognise privacy and security as a critical propriety for consumers. Reports constantly reveal that companies don’t have the right strategies in place to keep personal consumer information secure. Additionally, some studies have shown that one in ten companies give all their employees’ access to personal information, which means that they’re exposing themselves to new opportunities for fraud.

The first step is making sure that customer data is truly secure in the contact centre. One report from Symantec found that businesses may not always recognise privacy and security as a critical propriety for consumers. Reports constantly reveal that companies don’t have the right strategies in place to keep personal consumer information secure. Additionally, some studies have shown that one in ten companies give all their employees’ access to personal information, which means that they’re exposing themselves to new opportunities for fraud.

Security awareness is the first step to ensuring that all contact centre staff are prepared to offer a secure experience for customers. After all, a powerful security experience starts with implementing the right culture.

Technology Has Evolved to Protect Contact Centres

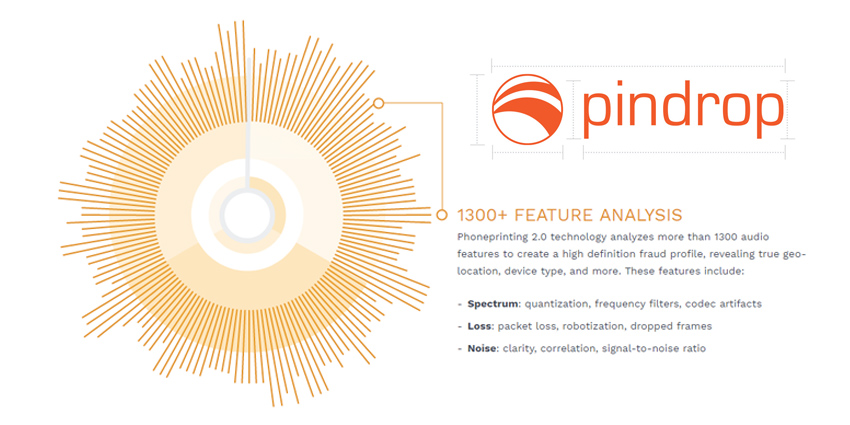

On the other hand, from a technology perspective, businesses should ensure that their infrastructure security is equipped to protect customer data from criminals. As fraudsters continue to grow more sophisticated, the technology designed to fight against them is evolving too. For instance, solutions that combine voice biometrics with machine learning like Pindrop’s flagship “Phoneprinting” technology, help companies to combat fraud before it becomes too much of a serious issue.

Phoneprinting or audio printing solutions create a unique fingerprint for each caller or customer in your portfolio, by analysing thousands of unique features within a call, including location, voice, and number history. Phoneprinting technology highlights unusual activity in a call, identifies the possibility for fraudulent activity, and helps to protect contact centres from the rising threats in the industry.

According to the experts behind Pindrop, because Phoneprinting protects the contact centre on multiple fronts at once, it helps to crack down on fraudulent tactics all the way from voice distortion, to ID spoofing, and social engineering, without asking customers to provide extra information. Phoneprinting could be more secure than voice biometrics, which focuses on one specific area of security for the contact centre environment.

Powering the Front Line of Contact Centre Security

The Fraudscape report and recent analytics conducted by Pindrop offer an insight into just how significant the need for better contact centre security is. Today’s companies need to take their strategies to the next level if they want to ensure that they’re keeping customer data secure – particularly when their clients are giving information away on social media.

With the UK government announcing their plans to spend nearly £2 billion on cyber security, and the upcoming General Data Protection Regulation (GDPR) guidelines almost here, it’s clear that customer data protection is a top concern for today’s contact centres. It’s time for everyone to get their act together to ensure that measures are taken both externally and internally to prevent against the rising threat of fraud.