Zoom has spent much of the last five years trying to expand the horizons of its own initial success as a household name in video conferencing. For some time now, the company has been undergoing an identity transition to prove to investors and tech buyers that it is far, far more than a pandemic-era utility; that it is a comprehensive business collaboration behemoth.

This quarter, Zoom delivered a statement result. Revenue rose 4.7 percent year-on-year to $1.217 billion, its fastest growth in nearly three years. Profits jumped sharply, and enterprise sales, the business Zoom most needs to win, climbed seven percent.

That momentum, fuelled by AI-powered products and contact centre wins, raises a strategic question: Despite Microsoft Teams’ dominance and Cisco Webex’s robust feature set and infrastructure, is Zoom becoming the most compelling all-in-one collaboration platform in 2025?

Eric Yuan, CEO, was emphatic:

AI is transforming the way we work together, and Zoom is at the forefront, driving innovation that helps people get more done, reduce costs, and deliver better experiences for customers and employees alike.”

Enterprise Growth: The Numbers Behind the Narrative

Zoom’s enterprise segment delivered $730.7 million in revenue, reflecting demand from larger organisations willing to embed the platform deeper into workflows. High-value customers grew nearly nine percent to 4,274, those contributing over $100,000 in trailing twelve-month revenue.

That matters for CIOs and CFOs because it signals growing trust in Zoom’s stability and scalability. Organisations rarely double down on secondary vendors in a market crowded with Microsoft, Cisco, and RingCentral. Zoom’s wins suggest a shift in perception from tactical tool to strategic partner.

AI as Differentiator

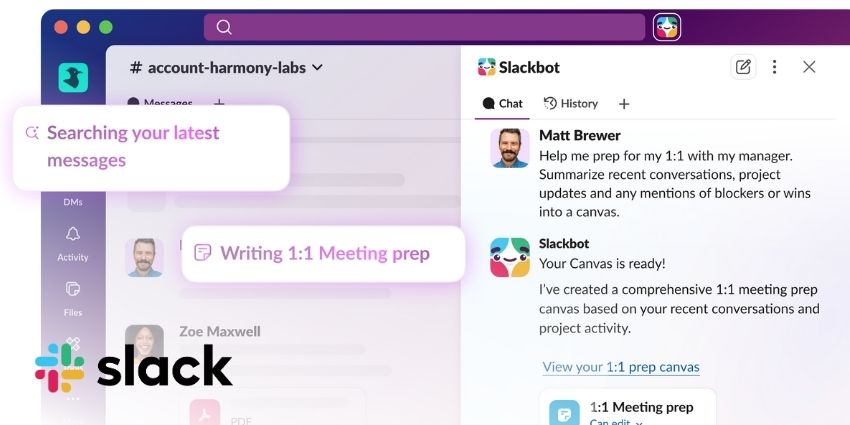

AI sits at the centre of Zoom’s game-changing narrative. Its Virtual Agent 2.0 can now handle returns and appointment booking, while a new Custom AI Companion integrates across rival platforms like Google Meet. Zoom is also adding AI concierges for contact centres to cut handling times and improve customer journeys.

For a CHRO, this is an employee experience story about removing friction from collaboration. For a CMO or CX leader, it is about automating customer engagement at scale. For a CIO, it is an integration play about whether Zoom’s AI can interoperate with existing UC stacks without multiplying complexity.

Profitability and Strategic Confidence

Financial discipline underpins the innovation push. Zoom reported a non-GAAP operating margin of 41.3 percent, up significantly, while generating $508 million in free cash flow and retaining $7.8 billion in cash. The company also repurchased six million shares this quarter.

For CFOs, these figures illustrate strong cash reserves and shareholder returns, consequently suggesting a vendor capable of sustaining R&D investment while keeping pricing competitive. In an age where tech buyers are sceptical of VC-fuelled loss-makers, Zoom is signalling durability.

Guidance: Setting Expectations Higher

Zoom also raised its full-year guidance to $4.825–$4.835 billion, with adjusted EPS at $5.81–$5.84. The market rewarded this confidence with a stock surge of more than 8 percent.

For tech buyers, this matters less as equity news than as reassurance. Zoom is investing from a position of strength.

What Tech Buyers Should Be Asking

Strong earnings reassure investors, but enterprise buyers measure value differently. Profitability and AI roadmaps matter only if they solve real problems, such as integrating with existing stacks, driving measurable savings, and improving customer and employee outcomes.

For CIOs and CTOs, the integration question looms large. Will Zoom’s AI tools work seamlessly alongside entrenched platforms like Microsoft Teams and Cisco Webex, or introduce new silos and lock-in risks? CFOs will want proof that automation delivers tangible returns. Do AI agents merely shave seconds off interactions, or can they cut costs, reduce churn, and lift margins in ways that justify investment?

HR leaders face a cultural test. Will AI copilots lighten workloads and improve adoption, or breed distrust if employees feel replaced rather than supported? CX and marketing leaders must judge whether Virtual Agent 2.0 strengthens brand consistency across channels or risks diluting the customer experience with generic automation.

For procurement teams and COOs, the concern is strategic balance. Does Zoom bring enough incremental value to justify adding another vendor, or does it deepen dependency in an already concentrated UC ecosystem?

Key Takeaways:

With its fastest growth in three years, strong enterprise revenue momentum, and ambitious AI rollouts, Zoom is positioning itself as a serious contender for the next generation of workplace collaboration.

This should put Zoom firmly back on the radar for tech buyers if it isn’t already. The company’s platform now spans meetings, contact centres, productivity tools, and AI copilots while preserving the intuitive UI it became renowned for during the pandemic. It represents an ecosystem that promises to cut friction, reduce costs, and improve experiences across employee and customer journeys.

That said, the decision isn’t automatic. Tech leaders must still weigh integration with existing platforms, the risk of vendor concentration, and whether the ROI from AI tools can be clearly demonstrated. However, dismissing Zoom as a lightweight alternative to Microsoft or Cisco would be a mistake. Its earnings momentum and product strategy suggest it deserves serious consideration in any digital workplace transformation, regardless of industry or company size.