Patrick is joined by expert guest John Macario, who is SVP for Global Channel Marketing at Ribbon.

Firstly John tells Patrick that helping its partners and customers to understand the unified communications market is crucial to Ribbon, and this was the fundamental reason behind the research being commissioned. John then gives Patrick some more information on the logistics of the survey. Ribbon reached out to over 4800 decision makers in businesses in over 23 countries from across the globe, in April this year, to get a snap shot of what the market looks like in terms of general attitudes towards UC. The research canvassed businesses of all sizes across different vertical markets to gather a universal summary.

Patrick asks John to summarise some of the highlights and surprising revelations from the research and John is also able to provide some insight into development trends as he has commissioned similar surveys in the past. John explains that by asking some preliminary questions Ribbon was able to split the correspondents into one of two categories: ‘UC Adopters’, those already deploying some form of modern unified communications technology, or ‘UC Non-adopters’, those still operating with more legacy based systems. This allowed Ribbon to ask more relevant questions to each subset of respondents about their current use of UC tech or attitudes towards potential future use.

“We wanted to get relevant insights from both aspects of those in the market, those who are already using the technology and also understand from those who aren’t yet adopting, what might make them move across to next gen technology.”

In terms of business size the results yielded some interesting findings with John explaining that there is generally less knowledge around UC within the smallest businesses.

“For the smallest companies in the survey – 60% chose the phrase ‘I am unaware of unified communications’,”

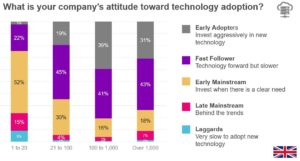

John doesn’t view this surprising revelation as a negative, but as a positive for the industry as a whole. If such a large segment of businesses are unaware of the technologies available, or the potential benefits to be gleaned then there is a huge opportunity to expand services into those markets. John explains that a businesses’ attitude to technology often forms the basis of any variation in willingness to adopt technology in new areas, and the survey also focused in on this.

“I fully expected that the smallest companies in the study would be more likely to be early adopters (of technology) – but in fact the results came back as exactly the opposite.”

The research unveiled that it was in fact much larger companies who were more likely to adopt emerging technologies at an early stage and John tells Patrick that this could be down to any number of factors, such as greater internal expertise in specific areas. The survey also unveiled similar results by asking how different businesses manage technology solutions, like ICT or communications.

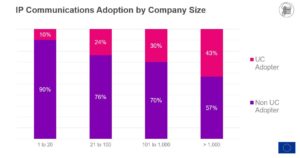

John also tells Patrick about the levels of IP adoption throughout the industry and again the research demonstrates the same correlation in terms of much lower adoption levels in smaller businesses. The opportunity is still there for the entire industry to try and capitalise on.

“When you think of these hundred to thousand employee companies, who have roughly 25% adoption, that’s a huge market still available.”

Patrick and John then discuss some of the reasons for the variation in adoption between smaller and larger businesses. Effectively businesses just wanted to understand the benefits and the ROI rather than the nuances of the technology itself.

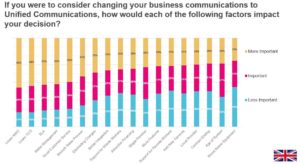

John then moves on to take Patrick through some of the potential drivers behind unified communication technology purchases. This varies remarkably depending on business size and vertical but several factors reoccur constantly; price, reliability and features.

“As you go up in company size we see a distinctive shift. Yes, economics is still important but the product itself, the feature attributes of the product – become more important.”

John describes some of the results that were gleaned in terms of whom organisations might want to buy new solutions from. Preferences appear to be more subtle with little differentiation in terms of favouring traditional providers or the new more disruptive vendors. John is surprised by some of the findings in this area and takes Patrick through the more interesting revelations.

Finally Patrick asks John for his overall thoughts on the findings. John tells Patrick that although some aspects have surprised him, overall he is enthused by the market opportunity that is available for the industry. The research showed that a huge proportion of the businesses surveyed are looking to purchase UC solutions in the near future and generally that is a massive positive for everyone in the space.

Listen on your daily commute, whilst walking the dog, or in the gym. UC Today – Out Loud provides bite size podcasts, bringing you all of the latest communication and collaboration news.

Rate, review, share on Apple Podcasts, and Buzzsprout, and join the conversation on LinkedIn, Twitter and email.

Presenter Patrick Watson and special guest John Macario from Ribbon.