Money makes the world go around – so they say, but it’s also a good indicator of where the market is heading. When we look at the top-performing brands in the UC industry from 2019, we can see clear trends toward more flexible, dynamic, and forward-thinking communication tools.

To celebrate some of the fastest-growing companies in the communication industry from this year, and help you figure out which tools are leading the way for 2020, we did our research. We’ve put together a list of the top-performing, billion-dollar brands from 2019, with a few useful insights into what they’ve accomplished this year.

(Figures as of 17th October 2019)

1. Zoom (M.Cap USD: 18.5 BN)

When it comes to incredible growth, Zoom is the name on everyone’s lips. Much more than just a video conferencing solution today, Video has grown to become a leading collaboration solution in its own right. Since entering the stock market in April, Zoom has wowed financial experts with a consistently high share price, and incredible amounts of demand.

Zoom is one of the highest-valued stocks in the tech industry today, with total revenue growth from the last quarter of 96%. Zoom also revealed this year that its trailing revenue has increased by 104% since 2018. With success after success leading the way for the brand, the only way is up.

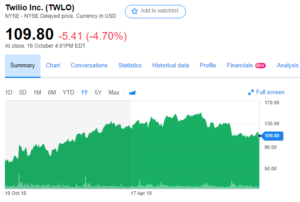

2. Twilio (M.Cap USD: 14.9 BN)

The unified communication, collaboration, and customer experience markets are packed full of people looking for more than just a one-size-fits-all solution today. Everyone wants a product that they can tailor-make to their required specifications – and that’s exactly what they get with Twilio. Twilio is a cloud communications and CPaaS company that allows companies to expand their existing tech stack with new communication tools through API.

For the fourth quarter of 2018, Twilio reported a $204.3 million revenue, which was an increase of 77% from 2017, and a 21% increase from the quarter before. We see Twilio’s revenue continuing to grow as more companies embrace the power of APIs.

Editor’s note: since the data was prepared for the article there has been a significant drop in Twilio stock due to a ‘math error’ – see the related story.

3. RingCentral (M.Cap USD: 14.1 BN)

RingCentral has been a successful company in the communications industry for some time now, but its value has gone up significantly in recent weeks, particularly after announcing a new partnership with Avaya. RingCentral’s share price has increased by around 1,206% over the past five years – highlighting the continued strength of the company.

Recently, RingCentral and Avaya’s announcement pushed shares up yet again, encouraging even more investors to get involved with what could be one of the biggest contenders in the UC industry as we enter 2020. The future looks bring for RingCentral, and Avaya as a result.

4. Slack (M.Cap USD: 12.8 BN)

Compared to some competitors, like Zoom, Slack hasn’t had the same rocket-powered launch into the stock market. However, that doesn’t mean that the business isn’t rapidly increasing in value. When Slack hit the public market, it raised $1.4 billion over 10 rounds. Slack picked a direct listing for their IPO, to help raise money for the company, and it seems as though future growth is on the cards too.

According to recent reports, Slack now has 12 million people using its product as of September 2019. Although the Slack stock price dropped a little over the last month, its announcement that it now has more users than ever is driving investors back into the company’s waiting arms.

5. Yealink (M.Cap USD: 5.7 BN)

Yealink is one of the only brand in our list for this year that proves companies in the UC&C market can still make a profit with a focus on IP phones and more traditional solutions. Yealink specialises in everything from video conferencing to voice communication and collaboration solutions. It’s also the number one in market share for SIP phone shipments.

According to recent research revealed this year, the Desktop phone market is continuing to generate vast amounts of value, particularly for vendors like Yealink. Currently, Yealink remains one of the biggest contenders in the industry when it comes to providing workers with their must-have hardware. (Figures converted from CNY to USD)

6. Five9 (M.Cap USD: 3.3 BN)

Another innovator in the marketplace for this year, Five9 is one of the leading providers of cloud contact centre solutions. Supporting the intelligent contact centre space, Five9 brings the power of cloud communications to businesses around the world, supporting around 5 billion call minutes per year. Five9 recently introduced its “Genius” platform as a scalable, secure, and compliant solution for communications.

In July, Five9 revealed its second quarter results for 2019, highlighting a revenue increase of 27%. The total revenue for this quarter was $77.4 million, compared to only $61.1 million for the same time last year. Cloud contact centre solutions are big news right now.

7. Vonage (M.Cap USD: 2.5 BN)

Vonage, like many of our top-performing brands for 2019, is one of the companies transforming the way that we think about business communications. Vonage specialises in providing fully-integrated solutions for contact centre and UC strategies. Perhaps the most exciting feature of Vonage lately is Nexmo; its API platform for customisable communication stacks. Nexmo allows businesses to build the environment that’s right for them, one modular tool at a time.

Vonage’s commitment to flexibility for the marketplace has helped it to grow significantly throughout 2019. During its second-quarter business earnings call for 2019 in August, Vonage reported revenues of $200 million.

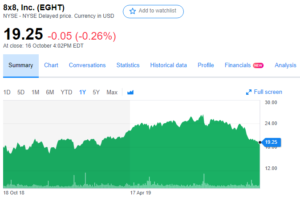

8. 8×8 (M.Cap USD: 1.9 BN)

8×8 is a company that always seems to be growing and improving in the current market. Offering state-of-the-art solutions for customer engagement and cloud communications, 8×8 stays ahead of the curve with innovative cloud-based video, voice, and contact centre offerings.

The last earnings update that was released for 8×8 this year came out in July, where 8×8 reported $0.14 earnings per share for the quarter, which beat the estimate provided by the Zacks’ consensus. The company also achieved a revenue of $96.68 million for the quarter, which was higher than the consensus estimate of $95.88 million. We’re currently waiting to see 8×8’s new earning release this month, but we’re relatively confident that the company will report continued growth heading into 2020.

Editor’s note: again, since, the data for this article was prepared, stock for Poly (PLT) has dropped below 1BN USD so they are no longer included in the list. Let us know your thoughts…

What do you think of our list of top performers for this year? Have we missed anyone worth mentioning? Let us know in the comments below.