The recent news of Mitel filing for Chapter 11 bankruptcy has sent ripples through the UC sector. For many, it recalls Avaya’s well-documented financial struggles. These events catalyse IT leaders to confront tough decisions about their tech roadmaps.

Whether it’s big-money PBX upgrades, licensing renewals, cloud migrations, or AI integrations, UC investments shape operational strategies for the next 5-10 years. Trusting a vendor teetering on financial instability presents serious risks. But what’s the best course of action when a vendor, such as Mitel, faces seismic challenges?

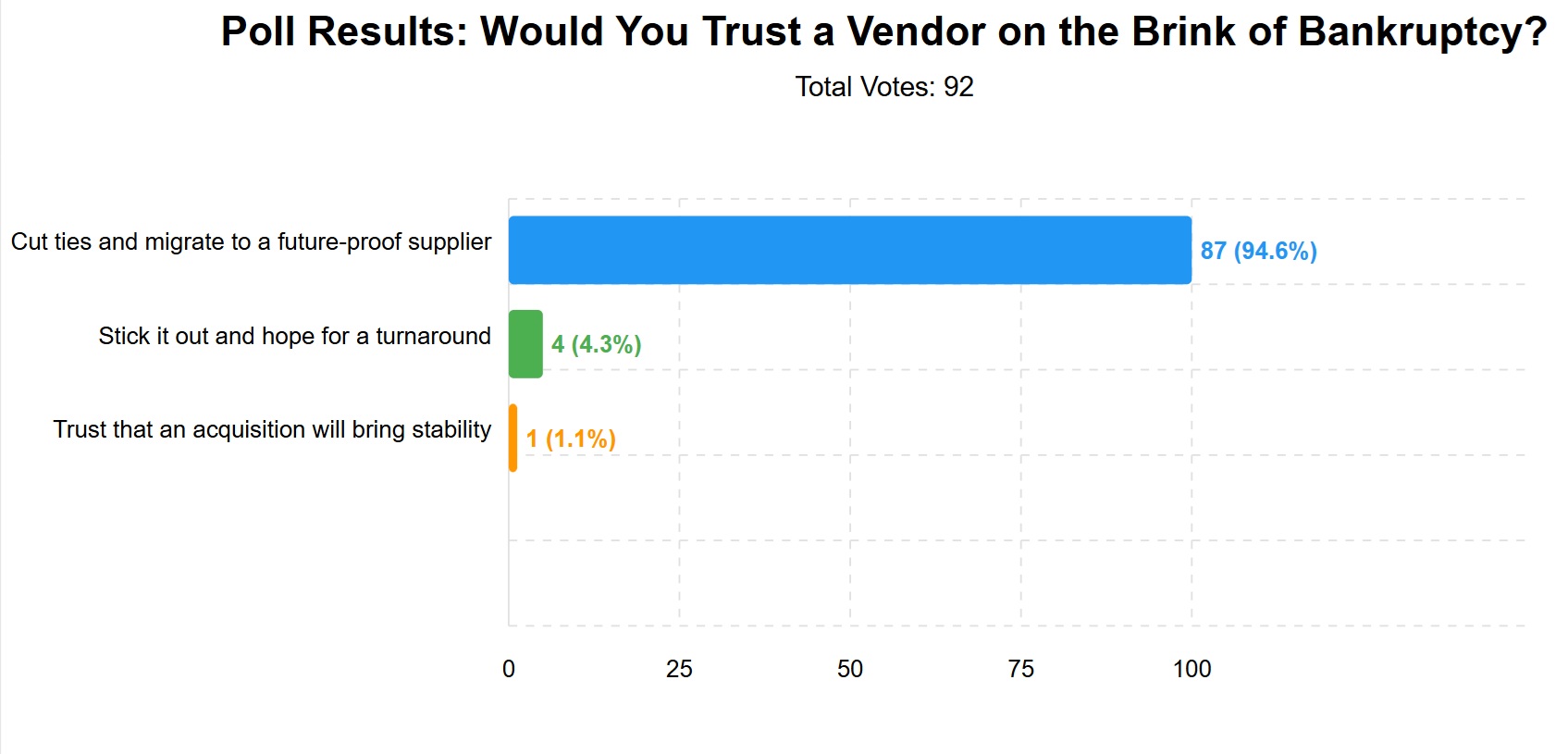

UC Today polled Reddit’s community of IT leaders and experts about what they would do if their UC vendor confronted bankruptcy. They were asked whether they would stick it out and hope for a turnaround, trust that an acquisition would bring stability, or cut ties and migrate to a future supplier. With 92 respondents, the results were strikingly convincing in one direction…

Stick It Out and Hope for a Turnaround?

For some, loyalty or contractual commitments might encourage staying the course. Only four out of 92 respondents among IT managers polled said they would “stick it out and hope for a turnaround”.

The logic is understandable: exiting contracts prematurely can be costly, and vendors in bankruptcy might still deliver on support and service obligations. There’s also the potential benefit of maintaining continuity and avoiding the disruption of migration.

One Reddit user, who caveated that they are a vendor, offered a different perspective on how customers staying could significantly help support vendors recover in the process:

1. Your deal can help save the vendor from bankruptcy.. this means more people would still have a job because of you and others like you. 2. You can also be the final nail in the coffin. Look, perhaps you can work out a payment plan and other assurances that will save you in case something happens to the vendor. This is something that can even happen to well funded vendors.”

However, this approach is fraught with uncertainty. Bankruptcy restructures often involve budget cuts, staffing reductions, and delayed R&D investments, all of which can degrade service levels and innovation.

Another user highlighted precisely this risk of sticking rather than twisting, citing real-world experience.

“Not only because they could just go belly up one day (it’s happened!), but also people start jumping ship and you end up having a skeleton crew managing everything,” they commented. “We were working with one vendor where we couldn’t even get in touch with someone to renew. Both products that this has happened to were purchased and ‘mission critical’ (they weren’t) to the business units that just had to have them. Somehow they survived the collapse of both vendors.”

Vendors may struggle to meet evolving technological demands, and essential upgrades could be delayed or cancelled.

There’s also a reputational risk if future projects falter due to vendor instability. Sticking it out might be the path of least resistance, but it’s also the riskiest when future IT strategies hang in the balance.

Trust That an Acquisition Will Bring Stability?

Some IT leaders hold out hope for a strategic acquisition, believing that new ownership could stabilise the vendor’s trajectory. Yet, only one out of 92 respondents opted for this approach.

While acquisitions can inject fresh capital and vision, they also bring unpredictability. Changes in leadership, product roadmaps, and support structures can disrupt operations. New owners may pivot towards new market segments, altering long-standing service commitments.

Moreover, acquiring firms may prioritise integration with existing platforms, potentially sidelining legacy solutions. Customers could face forced migrations, reduced customisation options, or product sunsets, undermining long-term investments. Contract terms may also change, impacting cost structures and support levels.

“Even if you did decide to go with option one and they do stay afloat, there is nothing saying they can’t be acquired by another company you might not have chosen to do business with,” one Reddit user highlighted. “Now you’re stuck with this new company after you’ve invested all this money.”

Trusting in an acquisition is a gamble that may not align with the strategic timelines of critical IT initiatives. Without clear transparency about the acquiring company’s plans, the risk of disruption remains high.

Cut Ties and Migrate to a Future-Proof Supplier?

An overwhelming 87 out of 92 IT managers polled indicated they would “cut ties and migrate to a future-proof supplier”. This response reflects a pragmatic approach to long-term stability and innovation. Though migration can be complex and resource-intensive, it reduces exposure to financial risk and ensures alignment with evolving UC trends like cloud adoption and AI-driven communication solutions.

One Reddit user underlined the practical reality for the vast majority of organisations facing this decision:

Option 1: You trust everything will turn out alright and eventually you find out either way. Risk. Option 2: You choose one of the many other platforms by a company that isn’t having financial difficulties. No risk. There’s an obvious answer.”

Migrating early allows organisations to take control of their transition rather than being forced into reactive decisions if a vendor’s situation worsens. It also opens opportunities to leverage the latest technologies that can drive efficiency and competitive advantage. Moreover, future-proof suppliers typically offer more robust security, better scalability, and stronger support structures.

While the initial disruption and cost of migration may seem daunting, the long-term benefits often outweigh these challenges. The majority view it as a necessary step toward securing future success and ensuring their UC infrastructure remains resilient and innovative.

However, the crisis could also be viewed as an opportunity to secure a better deal with the vendor while still having an alternative migration plan ready in the background. As one Reddit user proposed: “I would leverage their situation for as good a price as I could get and hedge that by seeking an arrangement with another vendor, having a migration plan, and being ready to execute on it.”

Conclusion

When faced with a UC vendor on shaky ground, the majority of IT leaders favour proactive migration over risky loyalty. The stakes are too high for indecision.

Ensuring stability, innovation, and alignment with long-term business goals means investing in partners built for the future.

What do you think?

Should IT leaders stick around and hope for a turnaround? Believe an acquisition will course-correct? Or do you agree with the majority that cutting ties and moving on is best?

See the opinion poll and all the comments, and join the conversation on Reddit!