On November 1, 2025, Microsoft executed a sweeping overhaul of its productivity suite licensing following years of EU antitrust pressure. The move was hailed as a win for competition. Slack, which filed the original complaint, celebrated the outcome: not only could enterprises now buy Microsoft 365 without Teams attached, but Microsoft was also required to improve how rival communication tools integrate with its software ecosystem. For companies locked into Microsoft 365 but preferring Slack or Zoom, this was supposed to be liberation.

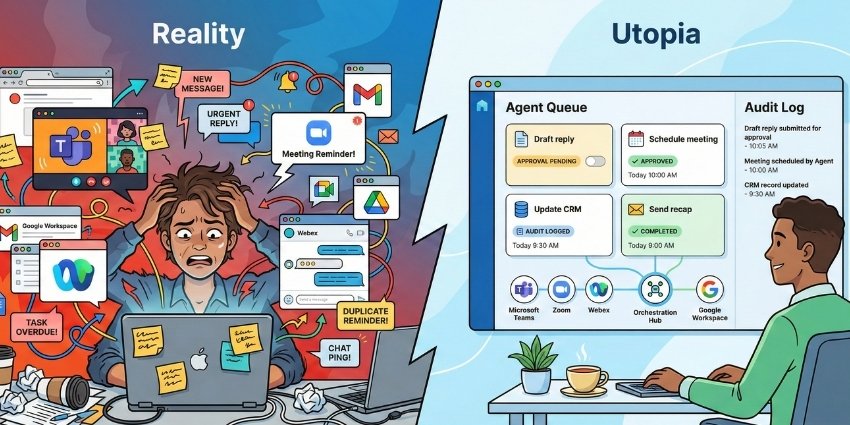

For most enterprises, however, the reality has been far less triumphant. The $8.55-per-user monthly saving from dropping Teams may be offset by added administrative complexity, lost ecosystem synergy, and the premium cost of third-party alternatives, making such a move redundant. Meanwhile, Microsoft’s dismantling of traditional volume discounts and its push toward AI-driven “Copilot” bundles has left enterprises facing additional expense.

The story of Teams unbundling, although framed as one of newfound choice, has replaced one issue with another. Understanding why requires looking at what actually changed in November 2025 and what it now costs to manage.

What Actually Changed in November 2025

The roots of the November 2025 restructure stretch back to July 2020, when Slack filed a formal antitrust complaint with the European Commission. The allegation was straightforward: by bundling Teams into Office 365 and Microsoft 365 at no additional visible cost, Microsoft was leveraging its dominant position in productivity software to crush competition in the collaboration market. The Commission’s investigation found merit in the claim. To avoid fines of up to 10% of global turnover—roughly $24.5 billion—Microsoft proposed a series of commitments in May 2025, formally accepted in September.

The commitments, many legally enforceable for seven years, required Microsoft to offer versions of its suites without Teams at a reduced price, allow existing customers to switch away from bundled packages during renewal, and improve technical interoperability for competitors. While the Commission’s focus was the European Economic Area, Microsoft opted for a global rollout to maintain operational consistency and perhaps preempt similar regulatory actions elsewhere.

Microsoft reintroduced the ability for customers worldwide to purchase Microsoft 365 and Office 365 Enterprise suites with Teams included, rolling back the global unbundling that had been in place since April 2024. However, the “no Teams” versions remained as permanent, lower-priced alternatives. This created a dual-track licensing reality: organizations must now explicitly choose between an integrated ecosystem and a modular approach.

The most critical mechanism is the “price delta,” the fixed difference in cost between a suite with Teams and one without it. In the Enterprise tier (E3 and E5), Microsoft established a minimum delta of $8.55 per user per month. This delta is not merely a pricing choice but a regulatory requirement designed to ensure that the Teams component has a transparent and separable economic value. Microsoft Teams Enterprise is offered as a standalone product for exactly $8.55 per user per month, achieving what the company calls “economic neutrality”: an organization that chooses an unbundled suite and later adds Teams separately pays the same total amount as one that licenses the bundled suite from the outset.

On paper, this looks like choice. In practice, it has introduced administrative and financial complexity that few organizations were prepared for and that many now find more expensive than the bundle ever was.

Does Unbundling Increase Total Spend?

The promise of unbundling was simple: organizations could save $8.55 per user per month by dropping Teams and choosing a best-of-breed alternative. For a 10,000-user enterprise, that theoretically translates to $85,500 in monthly savings. But the financial reality is far more complex.

Simon Gammon, Cloud Services Director at Nexus, explains: “From what we’re seeing across the organizations we support, Microsoft’s decision to unbundle Teams from certain enterprise licenses has not reduced cost for most customers. In many cases, it’s increased total cost of ownership while introducing new layers of procurement and licensing complexity.”

The issue is twofold. First, the $8.55 saving is quickly consumed by the cost of a third-party collaboration tool. Slack’s Pro plan costs $7.25 per user per month, which appears slightly cheaper, but it lacks the deep integration and advanced features many enterprises require. Upgrading to Slack’s Business+ plan, which includes SSO, advanced AI recaps, and enhanced security, costs $15.00 per user per month. For a 10,000-user organization, that’s $150,000 per month.

Second, unbundling has exposed redundancy and compliance gaps. Tyler Higgins, Managing Director at AArete, notes: “Unbundling has exposed widespread redundancy and compliance gaps, with organizations carrying overlapping licenses or paying for users who no longer require full collaboration access. In practice, this creates a scenario where unbundling shifts cost visibility, not cost burden.”

The most significant long-term financial impact stems from dismantling the traditional Enterprise Agreement discount structure. Although not directly related to Teams unbundling, its timing meant the costs were seen together.

Effective November 1, 2025, Microsoft began removing tiered discounts for all Online Services. Organizations whose renewals fall after this date are being transitioned to a flat, list-rate pricing model. For a large enterprise that historically benefited from a Level D discount (typically 15,000+ seats), the removal of this discount represents a substantial increase in IT expenditure. Some estimates suggest that organizations renewing in 2026 will see baseline increases of 12% to 15%.

Tomás O’Leary, Founder and CEO of Origina, questions whether Teams unbundling was a useful excuse to usher in the change: “The concern we’re hearing from enterprises is when unbundling is used to repackage existing functionality in a way that drives higher total cost of ownership, adds procurement complexity, or pressures customers to maintain the status quo at a higher price, it stops being pro-choice and starts feeling coercive. Many organizations are now being asked to pay more simply to stand still or to make decisions on a vendor’s timeline rather than their own.”

For most enterprises, the combination of unbundling complexity, lost volume discounts, and the high cost of third-party alternatives has resulted in a net increase in spending.

A Competitive Opening That Hasn’t Materialized?

Unbundling was supposed to open the market to competitors such as Slack, Zoom, and Webex. But market share data from 2025 and early 2026 tells a different story. By late 2025, Microsoft Teams held over 40% of the global collaboration platform market, with up to 320 million daily active users. Slack’s market share remained around 13% in the same segment.

Patrick Watson, Director of Research at Cavell, explains why: “Microsoft’s move simply came too late. By the time Teams was separated from the wider Microsoft 365 suite, it had already reached more than 300 million users and become deeply embedded across core productivity applications. Our research with more than 400 Teams decision-makers in the UK and US shows this clearly. Eighty-six percent purchased Teams as part of a 365 bundle, and 84% said they would have bought Teams even if it had been a standalone service. In other words, unbundling has had very limited market impact.”

Competition between Teams and Slack has evolved into a segmented rivalry based on company size and industry rather than a broad market battle. Teams remains the default choice for 90% of Fortune 500 companies that value its deep integration with Microsoft 365 governance and security features. Slack, conversely, dominates organizations with under 500 employees, holding a 52% market share in that segment.

Higgins offers a measured view: “Unbundling should create an opening for competitors, but the benefit is more selective than many expect. Platforms like Slack may gain traction in targeted environments, particularly if procurement teams are already running sourcing events tied to broader software rationalization efforts. Even then, wholesale displacement remains unlikely for most large organizations. Teams is deeply integrated into operational procedures.”

What Did the Teams Unbundling Really Achieve for the UCaaS Market?

The November 2025 Teams unbundling was designed to restore competitive balance to the unified communications market. On paper, it succeeded: enterprises now have the explicit right to purchase Microsoft 365 without Teams, and rival platforms have secured commitments for improved interoperability. But the gap between regulatory intent and market reality remains wide.

For most enterprises, unbundling has not translated into meaningful choice. The $8.55-per-user saving is absorbed by administrative overhead, compliance risks, and the premium cost of integrating third-party platforms. The simultaneous removal of volume-based Enterprise Agreement discounts has compounded the financial burden, leaving organizations facing baseline cost increases of 12% to 15%—far outweighing any theoretical benefit from modular licensing.

Competitors have gained technical access but not market traction. Teams’ dominance in the enterprise segment remains largely unchallenged, with 90% of Fortune 500 companies continuing to rely on it as their primary collaboration platform. Slack and Zoom have carved out strongholds in specific segments, but wholesale displacement has not materialized. For many, the unbundling arrived years too late to prevent the ecosystem lock-in that now defines the UCaaS landscape.

Perhaps the most significant outcome is one regulators did not anticipate: the shift from product bundling to data- and AI-driven lock-in. As Microsoft layers Copilot and other AI services onto its productivity suite, the value proposition is no longer about whether Teams is “free.” It is about whether an organization’s entire data estate is optimized for Microsoft’s intelligence layer. In this context, unbundling a single application feels like a hindrance, not a freedom to pick the best-of-breed.

The unbundling may have satisfied the letter of antitrust law, but it has yet done little to shift the balance of power in the UCaaS market. If anything, it has reinforced the gravitational pull of the Microsoft ecosystem, proving that dominance built on integration is far harder to dismantle than dominance built on price.