Reports of the ‘death of the deskphone’ appear to be largely premature according to the latest MZA research in global endpoint sales and trends, but the landscape is changing and the future is far from certain.

The findings by research company MZA analysed the performance of the business telephone and conference phone market, together with the underlying performance of some of the key communications solutions and tools that influence their sales and uncovered some interesting changes.

The overall endpoint market has remained relatively static over the last 3 years with 28.3 million endpoints sold throughout the world in 2017 appearing to lay to rest assertions in some quarters that the deskphone is now nothing more than a museum piece. However, that statistics masks some interesting intelligence that sits just below the surface.

The trend for non-proprietary SIP phones to take market share from proprietary SIP and Digital has continued to gather pace and has seen a strong 20% growth during 2017 as users transition to cloud-based solutions. There is also evidence to suggest that user habits still favour a deskphone with the use of other devices and tools based on location and task in hand.

“The advent of cloud has seen significant growth in those non-proprietary SIP desk phones that are promoted in association with cloud based, particularly multi-tenant based, business telephony services,” states the MZA report. “These non-proprietary SIP telephones are also popular in other 3rd party call control environments, as businesses look to deploy cost effective desk telephones that are compatible with a variety of different underlying platforms.”

“This has certainly helped counter the trend that had been witnessed in proprietary IP, digital and analogue desk telephones, where ongoing declines have been witnessed.”

The migration by users to more cloud-centric Unified Communications applications is only one of the trends that is influencing the endpoint landscape and the others are no less disruptive. The change in the working environment is also having a dramatic effect on the choice of device and application as the majority are no longer tied to a single workplace. It is expected that this trend will only increase as mobile technology improves and the changing demographic of the workforce.

“Communications and work is conducted on the move, from different locations including, for example home, while travelling, hotdesking in open shared workspaces, and in terms of team working, groups are working from small/huddle rooms to large dedicated meeting rooms. This in turn demands a change in the type of devices and endpoints that enable the optimum and most effective communications experience considering the environment from which the communication is being made. ”

And it is arguably the advancements and evolution of mobile technology that is, in part at least, fuelling the consumer’s expectations in terms of ease of access to communications tools, regardless of location, and driven desire for more seamless transition between mobile and fixed communications endpoints and devices. It is also important to notice the rise of the softphone clients on both the mobile and desktop environment. Whilst this has the potential to massively impact the endpoint market, for now at least users are preferring to have both running side-by-side and choosing which option is best at the time of requirement.

“These clients are typically used with headsets (both wired and wireless) but also are frequently used in addition to a deskphone with the client also used to control the desk telephone. Conferencing solutions (audio, video and web) continue to grow (representing 7.8 bn USD revenue in 2017) and have fuelled growth in audio and video conferencing endpoints as well as stimulating sales of headsets.”

All of this disruption has had a number of impacts on the endpoint market, not least of which is the dramatic shift in average endpoint price, particularly within the video conferencing arena. VC endpoints have enjoyed a 10% increase in volumes overall but the revenues have remained static. This has focused the vendors on delivering more cost effective solutions but has also encouraged new entrants into the market.

“The future prognosis is that over time sales of desk telephones will decline, under pressure from headset and mobile usage,” continues the report. “There will be a continued shift towards open non-proprietary SIP standards, but volumes certainly in the short to medium term will remain significant, fuelled by some users still favouring having a desk telephone to suit their work environment, while using other devices and tools dependant on task and location.”

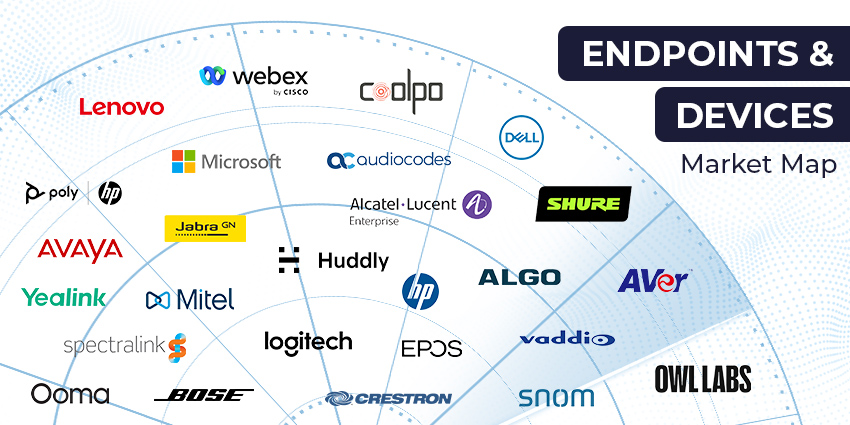

The report has also looked at the competitive landscape in terms of vendors and this has also seen a number of significant changes as the more established vendors from a strong communications background are joined by new players focused on the opportunities presented in the non-proprietary SIP space. Cisco retains the overall leader position in terms of IP and SIP endpoints with 25% market share, almost twice as much as their nearest rivals Yealink, who overtook Polycom to take the number two spot during 2017. Continually challenging the leaders are the raft of players focussed on open standards SIP telephones including more established companies such as Grandstream and Snom/VTech as well and some new names such as HTek and Fanvil.

In a survey of their distribution and reseller partners, Snom were able to recognise the same trends, although with some slight regional differences. “We found that 88% of our UK partners believe the desk phone has a future in business communications requirements,” explained Gernot Sagl, CEO of Snom. “As MZA have discovered, reports of the death of the desk phone have been greatly exaggerated. However, we did notice a slight degree of scepticism in Italy (81%) but no tendencies that would suggest an immediate decline in IP end point demand.”

“In fact, we are finding increasingly that specialised IP phone solutions for healthcare, logistics and heavy industry are being actively sought, while the trend in our core markets to all-IP has seen a huge increase in demand overall.”

It is also significant to note that a recent trend with a number of vendors who had played in the past predominantly in proprietary segments tied to their sales of call control platforms, are now all placing increased investment and focus on building out open non-proprietary SIP portfolios, for use both with their own platforms and services but also to address 3rd party solutions providers.

The headset market, is increasingly an area of focus not just for those traditionally strong market leaders Plantronics and GN Netcom/Jabra and more recently Sennheiser, but also for those other communications endpoints vendors who naturally see the opportunity to offer differentiated experiences and integration with their other UC endpoints and solutions. This area offers attractive opportunities and revenues which has resulted in new market entrants, an example being Cisco with their range of wired and wireless business headsets. This market will continue to attract new players. The coming together of Plantronics and Polycom recognised the diversity of business users’ endpoint needs and the desire to offer complete portfolios offering quality audio and user experience across the variety of form factors.