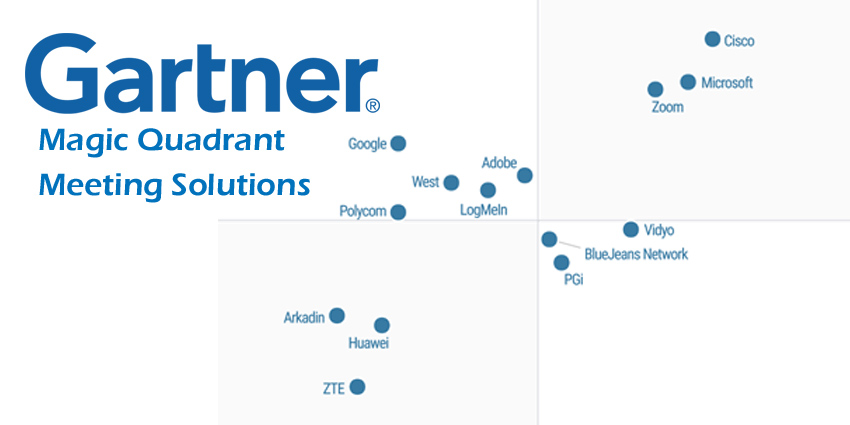

Gartner considers “Meeting Solutions” to be communication strategies that blend content, collaboration, and communication to allow for real-time productivity in the workforce. With its Magic Quadrant, the analytics firm hopes to draw attention to the vendors that have the most potential in the meeting room space.

Here, we’ll take a look at the leaders, challengers, niche players, and visionaries that Gartner has highlighted for 2017, and their respective strengths and weaknesses.

Gartner Magic Quadrant Leaders

The “leaders” in the meeting room magic quadrant are the vendors that lead the pack in terms of completeness of vision, and ability to execute their innovations. Gartner suggests that the leaders in the Magic Quadrant must have significant market share, as well as a strong ability to respond to the needs of their customers. This year, we have:

Cisco

Cisco delivers Cisco WebEx, Spark, and Meeting Server for its cloud, hybrid, and on-premise deployments. According to Gartner, Cisco delivers some of the broadest solutions available for collaboration, with features perfect for a range of endpoints. However, Cisco’s product portfolio also contains offerings that overlap in terms of functionality, which can make choosing solutions more complex for customers.

Microsoft

Microsoft’s meeting solution is “Skype for Business”, there’s also Skype for Business online, and Microsoft Teams. Microsoft supports vertical industries across the world more deeply than any other competitor, with options for almost every sector. However, the ease of deployment for Microsoft options can depend on applications for media relay, edge, and content delivery integration.

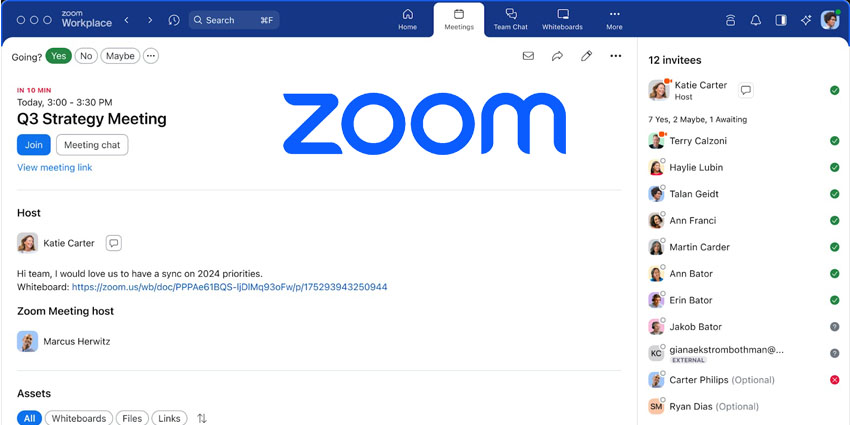

Zoom

Zoom provides SaaS, dedicated, hybrid, and managed service deployments for meeting solutions. According to Gartner, the vendor is an innovative option for customers, moving at a rapid pace, with ongoing service consistency and reliability. However, Zoom struggles when it comes to interoperability with legacy meeting solutions.

Gartner Magic Quadrant Challengers

The “challengers” for the Gartner magic quadrant are the vendors that fell slightly short of the leader position. Although they have “operational excellence”, and plenty of impact on the market, they’re not as powerful as the current leading vendors. This year, we have:

Google provides Hangouts Chat and Hangouts Meet for SaaS. Google has exceptional market awareness for Hangouts, thanks to a re-energised focus on the enterprise, and the re-engineering of meeting experiences through Jamboard. Unfortunately, it’s best for teams with fewer than 50 endpoints, which means it may not be ideal for larger companies.

West

West offers managed service deployments and SaaS for the “Intercall Conferencing” and Intercall Unified Meeting 5 products. West provides exceptional service consistency, reliability, and audio quality. However, the vendor is currently moving at a relatively slow pace in terms of innovation and development.

Polycom

Polycom offers a hardware-based infrastructure for on-premise deployment, as well as RealPresence for SaaS. Polycom has a rich channel ecosystem which allows for the sale of meeting solutions across a range of global regions. However, it relies on partnerships with Zoom for VaaS functionality.

LogMeIn

LogMeIn delivers GoToTraining, GoToMeeting, GoToConference, and GoToWebinar, as well as Join.me for SaaS. LogMeIn provides popular meeting solutions for businesses and enterprise, at a scale much larger than many competitors. However, it’s “InRoom” link meeting service is a young solution in a field brimming with mature competitors.

Adobe

Adobe provides managed service deployments, on-premise, and SaaS solutions for Adobe Connect. The Adobe strategy addresses the customisation needs of the education, healthcare, and finance sectors, as well as the US government. However, the vendor has fewer subscription models than some of its competitors.

Gartner Magic Quadrant Niche Players

The “niche players” in the Gartner magic quadrant are the vendors that show value in their ability to execute innovation but may be lacking in completeness of vision. Although the technology they use is high in quality, these vendors simply don’t have enough potential for growth thanks to financial circumstances, market focus, or geographic circumstances. This year, we have:

Arkadin

Arkadin provides “Arkadin Vision” and “Arkadin Anywhere” for SaaS. The vendor provides exceptional ease of deployment and fantastic audio quality as part of its compelling strengths. However, the meeting solutions available currently lack integration options for some vertical market segments.

Huawei

Huawei offers cloud-based video conferencing for SaaS and hardware-based video endpoints. Its extensive portfolio of endpoints and infrastructure makes it great for enterprise meeting options in a range of shapes and sizes. However, the company needs to improve integration with other services and software for a more robust meeting experience.

ZTE

ZTE offers infrastructure and hardware-based endpoints for on-premise deployments, as well as TrueMeet for SaaS. Many customers appreciate ZTE’s amazing video quality for video conferencing purposes. However, there are limitations in the feature set and APIs for this vendor. Customers would appreciate more plug-ins and external products.

Gartner Magic Quadrant Visionaries

Finally, “visionaries” are the vendors with the most completeness of vision, but not enough ability to execute their innovations. Though visionaries have unique, well-developed capabilities in terms of technology, they don’t have the support and sales ability to influence the market overall. This year we have:

PGi

PGi offers hybrid and SaaS deployments for GlobalMeet, iMeet, and ReadyTalk. PGi offers a powerful set of meeting capabilities, along with high-quality audio, which allows it to address numerous use cases. However, PGi is falling behind the crowd in terms of innovation and development.

Vidyo

Vidyo offers on-premise, SaaS, dedicated and managed service deployments, and hybrid for its products. The vendor provides fantastic service consistency, video quality, and reliability. However, it has fewer meeting solution features than most competitors on the Magic Report, which prevents it from becoming an industry leader.

BlueJeans Network

BlueJeans Network provides the BlueJeans meeting solution for SaaS. The vendor is well-liked in the marketplace for its easy integration. However, Gartner believes that the company would serve customers better if it accessed more external products and plug-ins within its meeting services.

Finishing Thoughts on the Magic Quadrant

As always, it’s important to take the Magic Quadrant with a pinch of salt. While it can give us an insight into the world of meeting solutions, it’s by no means a full representation of what’s out there on the market today. Saying that the planning assumptions that Gartner draws attention to in their Magic Quadrant highlight interesting concepts, for instance, they believe that WebRTC will account for 15% of enterprise video and voice by 2019 and that 30% of meetings will be supplemented by advanced analytics by 2020.

Gartner also believes that 60% of web conferencing will come from a web conferencing provider by 2021 and that through 2021, infrastructure spending will decline at a compound rate of 11%. As always, it’s hard to know for sure what the future holds, but what we can say, is that the popularity meeting room is growing. Do you agree with the latest Magic Quadrant report for meeting solutions? Let us know your thoughts in the comments below.