, andThe unified communications market has changed in just a handful of years. Once, it was just about aligning phones, chat, and maybe email. Now, UC is the foundation of the enterprise tech stack.

It’s the system combining all the tools teams need to increase revenue, enhance customer relationships, boost collaboration, and reduce operating costs.

Although demand for intuitive UC solutions has been increasing for a while, interest in this market has skyrocketed recently. The rise of new AI solutions for communication and collaboration, evolving customer expectations, and changing workplace environments have set the stage for phenomenal UC growth. Grand View Research says by 2030, this market will be worth over $417.9 billion.

Other analysts are even more optimistic. By 2032, Globe Newswire says the space will reach a value of $595.1 billion. That kind of growth doesn’t happen by accident. It happens when remote work becomes permanent. When AI starts writing meeting notes. When video calls replace hallways, and a missed message means a missed opportunity.

For IT leaders, this isn’t about catching up, it’s about choosing the right stack before the rest of the business outgrows the one you’ve got.

Based on the latest market reports and our proprietary research, here’s everything you need to know about the UC Market today.

What is Unified Communications? A Brief Introduction

Unified Communications, or “UC,” is an umbrella term for a comprehensive, integrated communication solutions toolkit.

The technology aligns various communication platforms and tools within a business environment, bridging the gaps between file sharing, calling, and messaging solutions.

As the communication landscape evolves, Unified Communications solutions are transforming, too. Today’s platforms don’t just provide users with a way to switch between different communication modes in a single pane of glass. They also support team collaboration with presence, file-sharing, and knowledge-sharing features.

Many UC systems, including those from leaders like Microsoft, Zoom, Google, and Cisco, also feature extensive AI capabilities powered by the rise of generative AI applications.

The modern UC stack doesn’t just unify tools, it unifies experience. Messaging, presence, meetings, file-sharing, integrations. AI summaries. Searchable transcripts. Real-time translation. Even workplace management baked in.

The Unified Communications Market: Size and Outlook

It’s easy to say UC is growing. But if you’re making strategic decisions, or pitching them to the board, you’ll need the numbers to back that up. Across analyst reports, those numbers vary.

Grandview Research valued the market at $136.11 billion in 2023, and predicts a growth rate of 17.4% through to 2030. Mordor Intelligence says the market for Unified Communications and Collaboration (UC&C) was worth $186.05 billion in 2025. By 2030, it’ll be worth $634.29 billion. That’s a CAGR of 27.8%.

Elsewhere, the IMARC group suggests the UC market will be worth around $468 billion by 2032, with significant opportunities emerging among larger enterprises in various regions.

Most analysts agree North America currently presents the most significant opportunity for UC vendors. However, thanks to increasing digitization efforts, the Asia Pacific region is expected to see substantial growth in the years ahead.

Additionally, while the large enterprise segment accounted for the highest market share in 2022 and 2023, opportunities are growing elsewhere. For instance, Grandview Research says the SME segment will expand at the highest rate (20%) up to 2030, thanks to the rise of cost-effective and flexible solutions for smaller businesses.

Our proprietary research also found that approximately 42% of companies were targeting the mid-market region in 2024. This could be due to the rising interest in generative AI solutions and workplace mobility among mid-market companies.

Then there’s the UCaaS segment to consider too. By 2034, Precedence Research believes this space will be worth $433.29 billion, indicating a heavy move to the cloud.

Evolving Opportunities in Cloud Unified Communications

Beyond new opportunities emerging in the SME and mid-market sector, and increasing interest in Unified Communications solutions in regions worldwide, additional factors are also beginning to shape the future of UC platforms.

According to IDC, UC collaboration software and UCaaS solutions with integrated telephony subscriptions accounted for the greatest market share in the UC market last year. There’s definitely a growing focus on cloud-based solutions.

In 2022, the on-premises segment for unified communications accounted for a revenue share of 47%, indicating that on-premises solutions are still popular – particularly among larger enterprises. However, the hosted and cloud-based UC segment is expected to register the highest growth (20% CAGR) through to 2030.

Companies are rapidly shifting to the cloud to reduce total ownership costs and operating expenses and access greater agility. Additionally, shifting market trends, like the impending PSTN/ISDN switch-off in various regions worldwide, drive a greater need for cloud technology.

For organizations with global operations, variable staffing, and a growing appetite for AI, the cloud has one big advantage: agility. It flexes, integrates, and updates itself while your teams keep working.

But it’s not all or nothing. Many enterprises are moving toward hybrid UC, mixing cloud-based apps with on-prem components for specific regions, teams, or functions.

Building the UC Stack: What It Includes, and Where to Start

Unified Communications isn’t one app, one feature, or one vendor. It’s a stack.

At the core of any UC stack, you’ll find voice, still the foundation. Whether that’s a cloud-based VoIP setup, direct routing into Microsoft Teams, or a more traditional telephony system. Above that sits messaging, video conferencing, presence, scheduling, file sharing, everything that keeps teams connected.

But UC doesn’t stop with meetings and messages. The modern stack also includes:

- Integrations with CRMs, ERPs, and ticketing systems

- Analytics and AI tools that summarize, suggest, and automate

- Service management layers for provisioning and performance

- Collaboration hardware that actually works when people walk into a room

- Governance and security features that satisfy compliance teams

It’s a lot. Which is why choosing the right vendors matters.

Not sure where to start?

Sometimes it helps to see the whole landscape. That’s why we’ve mapped it out, one vendor shortlist at a time.

Unified Communications Platforms Continue to Evolve

As company and customer expectations evolve, unified communications platforms are becoming more advanced. UC leaders are partnering with other organizations to align their platforms with contact center solutions, CRM systems, and critical tools.

There has also been a significant increase in demand for artificial intelligence baked into UC tools. AI systems like Microsoft Copilot, and Zoom AI Companion are emerging as critical components of modern UC solutions, allowing companies to streamline tasks and more effectively support workers.

Our research found that 69% of companies in the UC sector already saw AI as a promising adjacent technology to UC tools and a valuable growth opportunity in 2024.

Plus, While unified messaging systems remain popular in the unified communications market, there’s also a growing demand for streamlined, user-friendly video and audio conferencing tools with advanced meeting features. Even extended reality solutions, like Microsoft Mesh are gaining ground.

Companies are investing more heavily in UC solutions that can help them adhere to changing compliance standards and governance requirements, like digital communications governance.

Additionally, companies search for more holistic, AI-powered, and feature-rich UC platforms, certain vendors are rising to the top. Microsoft currently leads worldwide in the UC&C market, with a 44.7% market share. However, Zoom and Cisco are beginning to gain more attention.

There’s also a growing scope for smaller players to enter the market with unique service offerings focused on the needs of specific verticals and companies.

The Current Trends Unified Communications Market

For the last decade, the unified communications market has undergone a consistent change. The most significant driver of the UC market in the previous few years was the COVID-19 pandemic. The lockdowns and restrictions imposed by the pandemic forced businesses to implement digital technologies capable of enabling remote work.

COVID-19 also accelerated the digital transformation of the world as we know it. Companies and governments began implementing digitization projects to enhance business processes and improve team productivity.

Unified Communication and collaboration tools have become a lifeline for companies searching for unifying hybrid and remote workers. As innovations like IoT, 5G, AI, automation, and cloud computing evolve, the demand for enhanced UC tools will only grow.

As the workplace has evolved, and new digital innovations have emerged, unified communications platforms have become more robust, flexible, and intuitive. Organizations specializing in delivering UC services have not only introduced new features and capabilities for their platforms but are also making those systems easier to manage, deploy and purchase.

Going forward, several key trends will influence the nature of future UC platforms.

Increased Workplace Mobility and Flexibility

Demand for mobility and flexibility in the workplace is growing, even despite evolving return-to-office mandates. Companies today need to ensure they can support team members wherever they are, whether in the field, in the office, or working remotely.

We’re also seeing a rise in UC platforms with connected workplace management tools. Microsoft Teams, for instance, has Microsoft Places for desk booking and office management. UC vendors are partnering with phone operators on new solutions that make it easier for businesses to deliver consistent experiences to employees, regardless of location.

Flexible meeting policies are becoming more popular too. BYOM is the new normal, and UC platforms are adapting. That means easier wireless integrations, plug-and-play conferencing gear, and mobile apps that don’t feel like watered-down versions of desktop tools.

Changing Communication Styles

The way we communicate has drastically changed in recent years. Face-to-face and phone-based discussions are no longer the only options for business leaders. Teams rely on new solutions, such as messaging apps, for rapid knowledge sharing.

Video has also emerged as a core part of the modern communication strategy, allowing business leaders to connect agile workers in remote landscapes with in-office teams. Video is also becoming more intuitive, and artificial intelligence and automation tools are being implemented to improve inclusion and productivity.

Unified Communications platforms are becoming increasingly effective at empowering all types of workers. They offer access to multiple communication tools, assist teams with scheduling meetings, and share knowledge. We’re even seeing a rise in “asynchronous” solutions, like Zoom Clips, that help reduce the need for regular meetings.

AI also makes it easier for global teams to collaborate more efficiently with instant transcription, summarization, and translation tools.

Generative AI in UC Tools

Generative AI is perhaps the most significant trend to influence the Unified Communications market in recent years. Almost every leading vendor in the UC and contact center space has begun introducing generative AI assistants and companions into their platforms. Microsoft has Copilot, Zoom has AI Companion, and Google has Gemini.

Beyond giving users assistants that can generate content, summarize meetings, and automate tasks, UC vendors are also experimenting with other AI opportunities. Google, Zoom, and Microsoft are all experimenting with AI-powered teammates that can perform various tasks for employees. Soon, AI avatars might even be able to stand in for you in meetings.

Companies like Zoom are partnering with Perplexity AI, to bring advanced AI search capabilities into UC platforms. Going forward, the rising presence of AI in communication and collaboration tools will pave the way for better workplace efficiency and productivity, as well as reduced operating costs.

Consolidation and Integration

Rationalization has been a common trend in the unified communications market for some time now. Instead of using multiple separate “groups” of tools for customer service, data analysis, and internal collaboration, businesses are looking for ways to integrate their systems.

Metrigy’s Workplace Collaboration report for 2023-2024 found nearly half of all companies are attempting to shift to a single-vendor strategy for unified communications. Additionally, TechTarget found that around 76% of companies plan to move to a unified platform for employee and customer communications.

Converging UC platforms with contact center tools and even CPaaS platforms can help to minimize data silos. It can also improve interactions between cross-functional teams, leading to better customer experiences. Beyond this, companies are also looking for ways to integrate more supporting tools into a broader cloud-based solution.

Organizations increasingly want to ensure their UC platforms can connect with customer relationship management, enterprise resource planning, and workforce management tools. This trend will continue in the years ahead as businesses strive to reduce costs and improve productivity.

Security, Governance, and Compliance

As the Unified Communications market continues to expand and evolve, companies constantly face new security and compliance challenges and concerns. New governance standards are evolving, placing more pressure on companies to accurately capture and preserve data across various communications channels.

This will lead to organizations investing more time, effort, and money into protecting data from UC systems in the years ahead. Additionally, the rise of generative AI will lead to new governance concerns too.

Companies will have to be cautious about how they manage, deploy, and train generative AI tools, and they’ll need to prepare for new attacks. Generative AI makes it easier for criminals to access sensitive data. Now, malicious actors have access to advanced phishing schemes, deepfakes, and customized tools.

In the years ahead, businesses will need to ensure they’re working with UC vendors and solution providers that can offer end-to-end protection and security support. Discover the top UC security and compliance vendors in our market map.

What’s Next for the Unified Communications Market?

The Unified Communications market is no longer about getting calls to connect. It’s about building a communications strategy that adapts, across tools, teams, time zones, and technologies.

What’s coming next?

- AI will go from assistant to orchestrator, tying together meetings, messages, and context behind the scenes.

- Integration will move from a bonus to a baseline, especially across UC, CCaaS, CPaaS, and project tools.

- Security, governance, and compliance will shape every buying decision, especially in regulated sectors.

- Platform fatigue will push more IT leaders toward strategic consolidation, not because fewer tools are better, but because better tools should do more.

- Communication experiences will continue to evolve with extended reality, AI-powered avatars, and flexible meeting spaces.

If you’re navigating this shift, you don’t have to figure it out alone. Here are four ways to go deeper, faster:

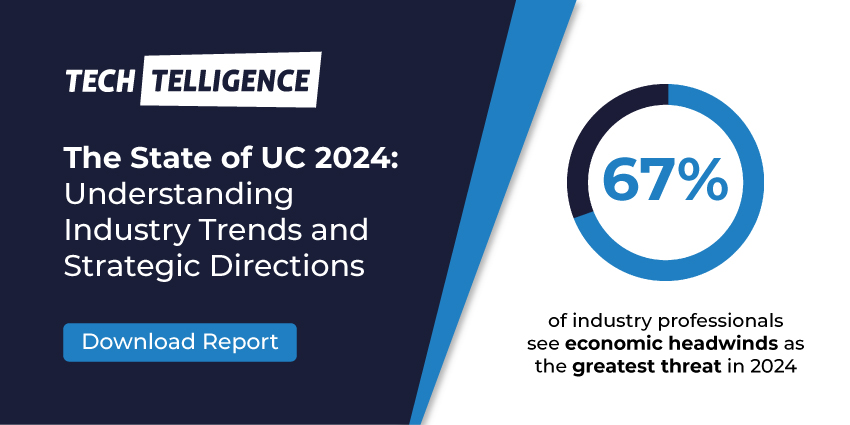

- Dive into the data: Download our latest research for exclusive insights on trends, vendor performance, and what’s reshaping the UC market.

- Join the conversation: Our UC Community is where IT leaders, collaboration pros, and digital workplace decision-makers swap ideas, challenges, and wins.

- Experience innovation in real time: Visit upcoming events and expos to see the latest UC tech in action. Meet the vendors. Hear from the experts.

- Master the buying process: Visit the UC marketplace for in-depth insights into all of the top vendors shaping the future of unified communications.

Innovations in unified communications will continue to help businesses optimize productivity, and performance, while reducing costs. The future of UC is bright. Make sure you’re prepared to take advantage of everything the market has to offer.