The UK’s public sector technology market represents a formidable opportunity.

Indeed, the nation’s National Health Service (NHS) is the world’s largest publicly funded health service. It’s therefore no wonder that the UK’s tech spend equates to £19.6 billion.

Yet despite the large reward, a recent analysis by Tussell and techUK reveals a stark reality: just 2% of companies capture an overwhelming 84% of this substantial market spend.

But why is there such difficulty in entering this vertical, and how have some companies managed to corner it?

To find out, UC Today spoke with 8×8’s Maxine Eunson, Head of Public Sector UK, about how the company has managed to thrive in the sector so much that they’ve been named one of the top UK public sector tech suppliers in this year’s Tech Titans Report.

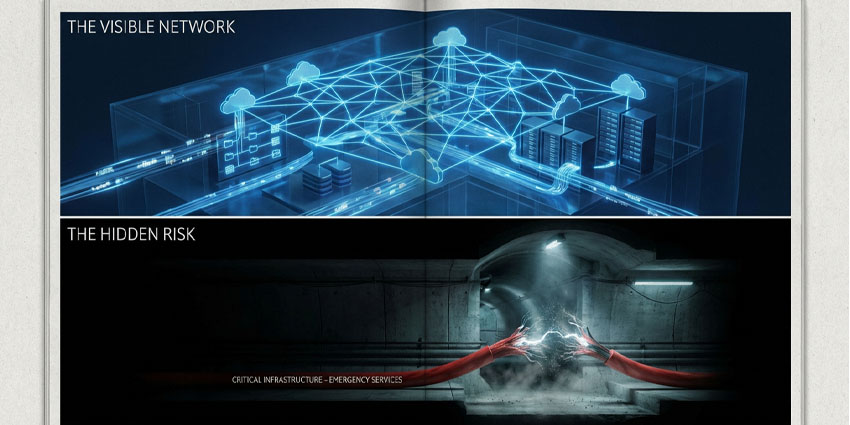

Understanding the Public Sector’s Situation

This concentration of cash being earned by a few companies underscores the difficulty many technology providers face when attempting to establish meaningful relationships with government bodies, healthcare trusts, councils, and educational institutions.

Therefore, breaking into this exclusive circle requires more than innovative technology or competitive pricing.

8×8’s journey reveals that the key to entry is credibility. This, Eunson explains, comes from demonstrating sector fluency rather than superior features.

“One of the biggest early lessons was that credibility in the public sector isn’t earned through product alone – it’s earned through patience, consistency, and a deep respect for how public services operate,”

Eunson says.

“Early on, we learned that simply having the right technology or the best technology offering wasn’t enough. We had to match that with sector fluency, procurement accessibility, and long-term partnership thinking.”

This insight exposes a common failure point for technology suppliers. Many enter the public sector assuming their commercial success will translate directly to government contracts. The reality is more complex – public sector buyers operate under different constraints, timelines, and success metrics than their commercial counterparts.

Underscoring this is the importance of understanding the approach to change in these sectors. 8×8 discovered that public sector organizations aren’t resistant to change like many vendors assume. Instead, Eunson argues, they’re resistant to vendors who don’t understand their operational reality.

“Many assume public sector organizations are slow to adopt cloud solutions or unwilling to change. In reality, they are eager for innovation but need vendors who understand their compliance, procurement, budget, and operational constraints,” Eunson notes.

This misconception costs suppliers significant opportunities. Public sector buyers are often more technically sophisticated than vendors assume, but they require solutions that work within established governance frameworks rather than around them.

Transforming for Public Sector Success

Recognizing the unique demands of public sector engagement, 8×8 made a strategic decision to build its foothold in this sector.

This started with creating dedicated organizational capabilities specifically for this vertical. It wasn’t simply about assigning sales teams to government accounts but fundamentally restructuring how the company approaches public sector relationships.

“The turning point wasn’t just a product or engagement decision – it was an organizational one,”

Eunson notes.

“We made a deliberate choice to build a dedicated public sector function with the right people, processes, and values to support government, healthcare, housing, and education bodies from first conversation through to lasting impact.”

This dedicated function spans the entire customer lifecycle, from initial engagement through long-term innovation partnerships. The team includes specialists in procurement processes, compliance requirements, and sector-specific implementation challenges.

This structure ensures that public sector clients work with professionals who understand their unique operational constraints and regulatory environment. The approach extends beyond traditional sales and support functions. 8×8 developed sector-specific blueprints and delivery models that reflect how public services procure and implement technology.

This attention to process alignment allows 8×8 to understand when and how to approach public sector organizations with innovative solutions, demonstrating they understand how they fit into the organization’s operations.

Success, as demonstrated by 8×8, requires adapting organizational structures to match these realities rather than expecting public sector buyers to conform to vendor preferences.

Navigating Complex Procurement Landscapes

The public sector’s reliance on established procurement frameworks creates both opportunities and challenges for technology suppliers.

To be eligible, suppliers generally need to register and, as part of that, meet certain requirements.

Frameworks like G-Cloud and Crown Commercial Service agreements in the UK provide structured pathways to market, but navigating these systems requires specific expertise and long-term commitment.

Public Sector Spending in Numbers

Public spending in the UK is roughly around 45% of the UK’s GDP

France has the highest public sector spend in the EU, at around 57%

The US, which doesn’t not have universal healthcare, comes in around 36%

Source: IMF

Yet, Eunson views frameworks as fundamental to the company’s mission: “To me, frameworks like G-Cloud and CCS are more than procurement routes – they’re how we deliver on our purpose: helping those who serve society, serve better. They give buyers confidence in our compliance, simplify access, and allow us to meet every organization where they are – technically, commercially, and operationally.”

Framework participation extends beyond listing services in catalogs. It requires maintaining ongoing compliance with evolving standards, demonstrating value through case studies, and building relationships with framework managers and buying organizations. As a result, the investment in framework management can often span years before generating significant returns.

Yet even with all their public sector success, 8×8 is not listed on every framework. Whether by strategic decisions or awaiting approval, companies can circumvent gaps by utilizing partner strategies to reach public sector buyers.

“Where we’re not listed, we work through trusted partners to ensure no public body is left without a path to progress,”

Eunson says.

“Resellers play a crucial role by bringing local expertise and trusted relationships.”

This partnership approach, however, requires careful selection of resellers who possess both technical competence and public sector relationships.

The procurement landscape also demands flexibility in commercial models. Public sector budgets operate on different cycles than commercial organizations, typically annual and aligned with the government’s fiscal year—with funding often allocated across multiple financial years—while commercial businesses can have varying budget cycles, often quarterly or rolling.

Suppliers who can accommodate these realities through flexible payment terms and modular implementations that align with available resources may become more attractive partners than those who work strictly on commercial calendars.

The Opportunity to Become a Public Sector Supplier

The ongoing digital transformation of UK public services creates significant opportunities for suppliers who understand sector-specific needs.

Indeed, the UK government, which has made the NHS a priority, has set a new 10-Year Health Plan to “build a health service fit for the future”, with one of the three tenets being a push from analog to digital. Therefore, the already substantial tech spend stands to increase.

For suppliers willing to make the changes needed to enter the inner circle of public sector spenders, Eunson sees a couple of upcoming changes that could serve as an entry point.

The PSTN switch-off, in particular, is forcing organizations to modernize their communications infrastructure, opening conversations about broader technology capabilities.

“Once we get past the PSTN switch-off and everything is digital, AI-driven analytics, real-time translation for multilingual communities, and predictive insights to improve service delivery are the big opportunities,” Eunson explains.

“We’re also seeing demand for integrating social and messaging channels into council and healthcare workflows.”

These opportunities reflect changing citizen expectations influenced by consumer technology experiences. Public sector staff and citizens increasingly expect government services to match the digital sophistication they encounter in commercial contexts. This expectation creates demand for omnichannel engagement capabilities and intuitive user interfaces.

8×8 is solidifying their position in this changing public sector by keeping their offering flexible.

“Our integrated platform is inherently modular, allowing public sector organizations to adopt what they need – whether UC, contact center, or CPaaS – and scale seamlessly as needs evolve, all on a single, secure platform,” Eunson says.

“When it comes to AI being a part of the stack we don’t force anyone to use our AI solution, unlike some companies. We pride ourselves on the integrations that we offer so you can take your existing AI and data – which will have been trained on your use cases and needs – and implement it straight into our tools.”

For suppliers seeking success in the public sector vertical, 8×8’s ability to capture the UK’s public sector tech spend reveals a clear blueprint: success demands organizational commitment, not just product innovation.

The companies that capture the lion’s share of the £19.6 billion market understand that public sector credibility comes from demonstrating sector fluency, investing in dedicated teams who speak the language of procurement and compliance, and building flexible platforms that integrate with existing systems rather than replacing them.