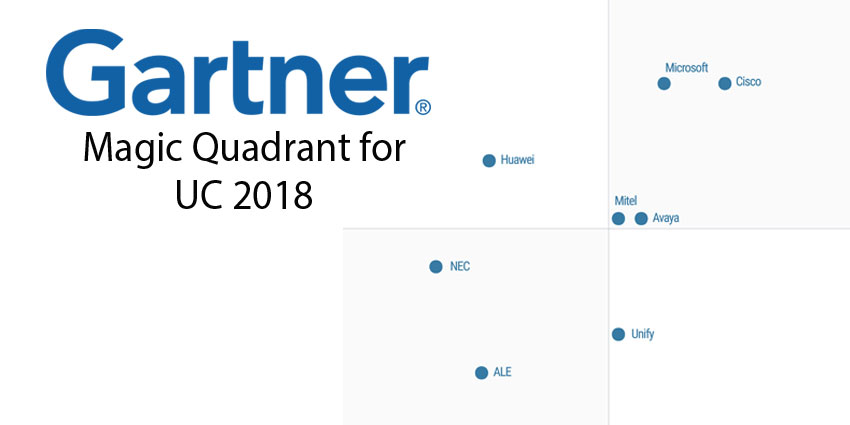

Gartner officially released its Magic Quadrant for Unified Communications this month, and we were lucky enough to get a sneak peek at the results pretty early on. As you probably know by now, the Gartner Magic Quadrant is probably one of the most commendable lists in the UC space – with everyone vying for a spot.

Note: If you’re looking for the UCaaS Magic Quadrant for 2018 you can find it here.

Compared to last year’s MQ, we’ve seen some significant changes in leadership positions. So, we’re going to give you a full run-down of everything you need to know about the big players, as well as the most significant changes that have happened in the UC market over the last 12 months.

Watch our Video Roundup

The UC Leaders for 2018

Let’s start with the big dogs. Last year, the brands in the top spot were:

- Cisco

- Microsoft

- Mitel

Gartner defines the leaders in their Magic Quadrant as vendors capable of offering a comprehensive UC portfolio, alongside a significant market presence. Leaders need to offer a wide selection of services to different kinds of enterprises and organisations. This year, our leaders are:

Avaya

You have to commend Avaya for their incredible performance over the last year. To move from a position of almost bankruptcy with Chapter 11, to one of the biggest players in the UC space is no simple feat. Avaya’s performance has left us in awe over 2018 as they’ve rolled out one exceptional market offering after another, from Avaya Equinox Meetings online, to Avaya Breeze, Zang Spaces, and more. Avaya even has the power to optimise UC with the addition of collaboration. One of the most compelling stories we’ve seen in UC for some time, Avaya is definitely one to watch.

Cisco

Cisco held onto their top spot for another year running thanks to a broad collection of UC solutions spanning cross-cloud, on-premise, and hybrid deployment options. Recently, the organisation re-branded their Cisco Spark portfolio to take advantage of the far more popular WebEx brand. The result has been an update to the marketing of tools like Webex Teams, Webex Meetings, Webex calling and more.

Microsoft

Another big player maintaining their position in the leadership space, Microsoft is just as powerful as ever in this year’s Magic Quadrant. Though the company chose not to participate in the MQ research process for this year, Gartner still conducted their research into the brand and decided that it was powerful enough to maintain a top spot. While Skype for Business remains a significant component of the Microsoft UC stack, Teams has gained a lot of traction this year, particularly with a slew of new updates like inline translation, and even a free tier.

Mitel

Finally, Mitel remains a strong contender in the UC market with its MiCollab UC suite. After its acquisition of ShoreTel, Mitel has been enjoying strength after strength in the unified communication space, with an expanded base of North American UC, and a range of new contact centre customers. The MiCollab solution supports everything from meeting solutions, to presence, calendaring, and even a tool for collaboration.

UC Challengers

Challengers are the vendors in the Magic Quadrant that indicate their ability to move into a leadership position but don’t yet have the power to make the jump. Last year, we saw Huawei and NEC in the space. This year, NEC has dropped out of the “Challenger” spot, leaving Huawei as the only contender.

Huawei

Huawei is a privately-owned business in China that’s been getting a lot of attention in recent years thanks to its innovative introductions into the communication space. The Huawei UC architecture is based on a virtual software platform that they’ve named the “Unified Session Manager.” The virtual solution allows Huawei to run its system on standard servers, Huawei servers, and virtual platforms. This year, Huawei has continued to expand their portfolio with new additions like an intelligent video endpoint called VPT300.

UC Visionaries

The visionaries in the MQ are vendors that deliver a unique and exciting approach to multiple areas of unified communications. These vendors have limited abilities to implement their ideas into new markets, which is why they can’t enter the leadership space. Last year, we had Unify and Avaya in the “visionary” section. However, since Avaya has moved into the leadership spot, Unify is left holding up the banner for those with an eye for upcoming innovation.

Unify

Unify is a particularly compelling brand in the UC space. A wholly-owned subsidiary of Atos, Unify offers a broad range of UC solutions under its OpenScape portfolio, which comes in four editions: Enterprise, Cloud, Enterprise Express, and Business. Customers can also explore the opportunities of OpenScape Fusion – an add-on that allows pre-integrations into other environments like Google G Suite, IBM, and Microsoft online. Unify Circuit allows the company to deliver collaboration solutions alongside a range of deployment options through the cloud, on-premise, and hybrid solutions.

UC Niche Players

Finally, the niche players in the Magic Quadrant are the companies offering solutions that have a particularly powerful impact on a certain aspect of UC. Last year, Alcatel Lucent Enterprise, or “ALE” featured in the niche space, alongside ShoreTel. Since ShoreTel was purchased by Mitel, we’re left with ALE and NEC in the niche space this year.

ALE

ALE, operating under the Alcatel-Lucent Enterprise brand, is one of the biggest innovators in the UC market today. They offer an OpenTouch Suite for their flagship multimedia offering, available through the powerful ALE partner network. The OTS offers a broad and integrated UC solution that scales up to 15,000 endpoints, and there’s the option to extend with the OmniPCX Enterprise Communication server. ALE’s go-to-market solutions also offer enhanced business services through Rainbow, which bring a breadth of fantastic UC options to the table.

NEC

Finally, Japan-based NEC is a global communication and IT provider offering a “Smart Enterprise” framework that includes a wide portfolio of products and services. NEC offers two on-premise UC solutions, as well as a /unified-communications/ucaas platform called UNIVERGE BLUE. NEC leverages the UNIVERGE 3C solution in their Smart Enterprise network to offer a broader selection of services to verticals like hospitality, healthcare, and finance.

Keeping Track of the Magic Quadrant

While the Magic Quadrant from Gartner might not be the broadest solution available on the market when it comes to comparing UC options, it is the list that most companies turn to for an insight into the space.

To rank unified communication services, Gartner believes that all the UC solutions they consider should be able to improve user experience (UX) and boost productivity within the business space. Gartner also defines UC solutions as anything that facilitates the use of multiple communication methods to achieve organisation aims.

What do you think of the Magic Quadrant this year? We’re particularly impressed by the performance of Unify, Avaya, and ALE – all companies who have shown exceptional innovation, resilience and commitment to great UC over the last year. Leave your thoughts in the comments below!

More Gartner News

- Avaya a Leader in Gartner 2018 MQ for Contact Centre Infrastructure

- Gartner Accolades Galore for NICE

- Gartner Customer Experience & Technologies Summit 2018

- Gartner Symposium/IT Expo 2018

- Gartner Digital Workspace Summit

- Leading the Way for Meeting Solutions: Cisco & the Gartner MQ

- Exploring Gartner’s Worldwide Magic Quadrant for UCaaS 2017

- Exploring the Gartner Magic Quadrant for Meeting Solutions

- How Trustworthy is the Gartner Magic Quadrant?

- Summarising Gartner’s Magic Quadrant for UC